Goods and Services Tax (GST)

Goods and Services Tax (GST):

The GST is a comprehensive indirect taxation system imposed on the provision of goods and services across India. It is a destination-base tax system that aims to replace multiple indirect taxes like excise duty, service tax, VAT (Value Added Tax), and others.

1. Introduction:

GST was introduce in India on July 1, 2017, with the goal of creating a unified and simplified tax system. It is govern by the Goods and Services Tax Council, which includes representatives from the central and state governments.

2. Key Features:

Destination-Based Tax: GST is levies at the point of consumption, ensuring that the tax revenue goes to the state where the goods or services are consumed. This contrasts with the earlier tax regime where taxes were levied at the origin (production point).

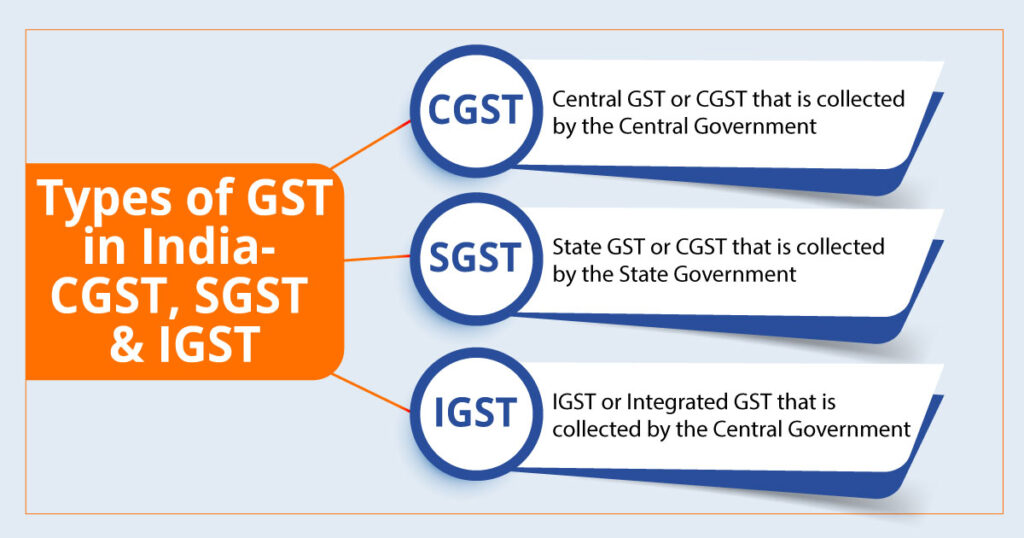

- Dual Structure: GST has a dual structure with Central GST (CGST) and State GST (SGST) applied on intra-state transactions. Integrated GST (IGST) is levies on inter-state transactions.

- Input Tax Credit: Businesses have the opportunity to claim credit for taxes paid on inputs (such as raw materials, services, etc.) by deducting them from the taxes they gather on their output.

- Composition Scheme: Small businesses with turnover below a certain threshold can opt for a composition scheme, where they pay a flat rate instead of the regular GST.

3. GST Rates:

GST is categoriz into four slabs – 5%, 12%, 18%, and 28%, with some essential items attracting 0% tax (exempted). Additionally, there is a cess on certain goods and services to fund specific programs.

4. GST Registration:

Businesses with a specified turnover threshold must register for GST. Different thresholds exist for goods and services, and they may vary between states.

5. GST Return Filing:

Registered businesses are requir to file regular GST returns, providing comprehensive information on their sales and purchases. Various forms are prescribed for different types of taxpayers.

6. Benefits: Simplification:

Replacing multiple taxes with a single tax has simplified the tax structure. Reduced Cascading Effect: Input tax credit ensures that taxes are not levied on already taxed components, reducing the cascading effect. Transparency: GST has increased transparency in the tax system, with a focus on digital documentation and online processes.

7. Challenges: Implementation Issues:

The initial implementation phase saw challenges due to the complexity of transitioning from the old tax system. Compliance Burden: Businesses often face challenges in understanding and complying with the various provisions of GST. Technology Infrastructure: The successful implementation of GST relies heavily on robust technology infrastructure, which can be a challenge in some areas.

8. Recent Developments:

GST laws and rates are subject to periodic changes based on economic conditions and government policies. Regular updates and amendments are made by the GST Council.

GST has had a significant impact on the Indian economy, simplifying the tax structure, promoting ease of doing business, and contributing to the overall growth of the country.

It continues to evolve as the government addresses challenges and makes improvements based on feedback from businesses and stakeholders.

FAQ’s on Goods and Services Tax:

1: Are GST and vat the same?

Ans: No, GST (Goods and Services Tax) and VAT (Value Added Tax) are not the same. While both are consumption-based indirect taxes, GST is more comprehensive, covering both goods and services, with a multi-stage tax structure and extensive input tax credit. VAT typically applies to the sale of goods only and is a single-stage tax with limited input tax credit.

2. Are GST council decisions binding?

Ans: Yes, GST Council decisions are binding on both the central and state governments in India.

3. Are GST and hst the same?

Ans: No, in India, GST (Goods and Services Tax) is use as the comprehensive indirect tax system, while HST (Harmonized Sales Tax) is not applicable.

4. Are GST rebates taxable?

Ans: GST rebates are generally not taxable as they represent a refund of taxes previously paid.

5. Are GST payments taxable?

Ans: No, GST (Goods and Services Tax) payments the mselves are not taxable. GST is a consumption-based indirect tax, and the payments made are part of the tax liability for goods and services supplied.

However, the GST amount is ultimately borne by the end consumer, who may not be able to claim input tax credits.

6. Can GST be claimed?

Ans: Yes, GST (Goods and Services Tax) can be claim as Input Tax Credit (ITC) by businesses. Input Tax Credit allows a business to claim credit for the GST paid on the purchase of goods and services, which can then be offset against the GST liability on sales.

This mechanism prevents the cascading effect of taxes and ensures that tax is paid only on the value addition at each stage of the supply chain.

It promotes the idea that businesses should only bear the final tax liability and not the cumulative tax on each stage of production or distribution.

7. Can GST be charged on mrp?

Ans: No, GST (Goods and Services Tax) is not calculate on the Maximum Retail Price (MRP) of goods. MRP is the highest price at which a product can be sold to the end consumer, and it already includes all taxes, including GST.

When a product is sell to the end consumer, the applicable GST is include in the MRP. The seller is responsible for remitting the GST portion to the government. Therefore, there is no additional GST charge on top of the MRP at the point of sale.

It’s essential for businesses to ensure that the MRP displayed on the product includes all applicable taxes to comply with legal requirements.

8. Can GST be paid by credit card?

Ans: Yes, GST (Goods and Services Tax) payments can be made using a credit card. The government provides various modes of payment for GST, and credit card payments are generally accept through online payment gateways.

Businesses and individuals can use their credit cards to make GST payments through the GST portal or authorized banks’ websites.

9. Can GST be claim on car?

Ans: Yes, GST can be claim as Input Tax Credit (ITC) on the purchase of a car, but conditions apply. The car must be use for business purposes, and restrictions may exist based on factors like capacity and specific use cases.

10. Can GST return be revise?

Ans: Yes, GST (Goods and Services Tax) returns can be revise within the prescribed time limit by filing an amended return to correct errors or include additional details.

11. Can GST be refund?

Ans: Yes, GST (Goods and Services Tax) can be refund under certain conditions. Businesses or individuals can apply for a GST refund in cases where they have accumulate excess Input Tax Credit (ITC) or if they qualify for specific refund provisions outlined in the GST laws.

12. Can GST number be transfer?

Ans: The transfer of a GST (Goods and Services Tax) number is not allowe in India. When a business undergoes changes such as a change in ownership, the new entity is require to obtain a new GST registration.

If there have been any changes or updates to the rules and regulations since my last update, I recommend checking the latest guidelines provided by the official GST portal or consulting with a tax professional for the most accurate and current information regarding the transfer of GST numbers.

Tax regulations are subject to changes, and it’s important to stay inform about the latest developments.

13. Can GST registration be cancel?

Ans: Yes, GST (Goods and Services Tax) registration can be cancel in cases such as business closure, transfer, change in constitution, or when taxable supplies fall below the threshold. To initiate cancellation, one must submit an application through the GST portal.

14. Can GST officer visit premises?

Ans: Yes, GST officers have the authority to visit business premises for verification, inspection, investigation, audit, or assessment purposes under the Goods and Services Tax system.

15. How GST is calculate?

Ans: GST (Goods and Services Tax) is calculate as a percentage of the taxable value of goods or services. The basic formula to compute GST is: GST Amount = (GST Rate100)×Taxable Value There are different GST rates for various goods and services, such as 5%, 12%, 18%, and 28%. The GST amount is add to the original cost to arrive at the total amount payable by the consumer.

Total Amount = Taxable Value + GST Amount

It’s important to identify the correct GST rate applicable to the goods or services being supply and calculate the tax accordingly. Additionally, businesses can claim Input Tax Credit (ITC) for the GST pay on their purchases, reducing the overall tax burden.

16. how GST works in india with example

Ans: GST is levy at each stage of the supply chain, and businesses can claim Input Tax Credit (ITC) for taxes paid on their purchases. Here’s a brief example: A manufacturer produces goods worth ₹1,000. If the GST rate is 18%, the manufacturer charges ₹180 as GST (18% of ₹1,000). The total invoice amount for the buyer becomes ₹1,180 (₹1,000 + ₹180).

17. When GST was introduce?

Ans: Goods and Services Tax (GST) was introduce in India on July 1, 2017. The implementation of GST mark a significant tax reform, replacing a complex and multi-layered indirect tax system with a unify and comprehensive tax structure.

The introduction of GST aim to simplify the taxation system, reduce cascading effects, and create a more transparent and business-friendly environment.

18. Where GST is not applicable?

Ans: The United States does not have a nationwide Goods and Services Tax (GST) or Value Added Tax (VAT) system. Instead, the U.S. uses a sales tax system, which varies by state and sometimes by locality within states.

However, tax systems can change, and new policies may be implement, so it’s advisable to verify the current tax regulations.

19. Where is GST shown in balance sheet?

Ans: In a balance sheet, Goods and Services Tax (GST) is typically shown in the “Current Liabilities” section, reflecting the GST payable or any outstanding tax liabilities.

Input Tax Credit (ITC) may appear as an asset under “Current Assets.” The specific presentation can vary base on accounting standards and the business’s accounting policies.

20. Which GST is applicable to intra state supply?

Ans: For intra-state supplies in India, both Central GST (CGST) and State GST (SGST) are applicable.

21. Which GST is applicable to interstate supply?

Ans: For interstate supplies in India, the applicable tax is Integrate Goods and Services Tax (IGST). In the GST system, IGST is levy on transactions involving the movement of goods or services from one state to another.

22. Who introduced GST first in india?

Ans: The idea of implementing Goods and Services Tax (GST) in India was first introduce by the Atal Bihari Vajpayee government in the early 2000s. However, the actual implementation of GST was carry out by the Narendra Modi-lead government.

The Constitution (122nd Amendment) Bill, 2014, which pav the way for the introduction of GST, was pass by the Parliament in 2016, and GST was officially launch on July 1, 2017.

23. Why GST is require?

Ans: GST is require for simplifying the tax structure, eliminating the cascading effect of taxes, promoting uniformity in taxation, boosting economic growth, reducing tax evasion, enhancing transparency, improving global competitiveness, and harmonizing indirect taxes for a more efficient and business-friendly system.

24. GST can be collect by which dealer?

Ans: GST can be collect by any dealer who is involve in the supply of goods or services. In the GST system, businesses that make taxable supplies are require to collect GST from their customers and remit it to the government. This includes manufacturers, wholesalers, retailers, service providers, and other entities engaged in the supply chain.

25. GST for gold?

Ans: Goods and Services Tax (GST) on gold in India is apply at a rate of 3%. However, it’s important to understand that tax rates may be subject to change. gold attracts a 3% GST rate, which is levies on the value of the gold, including making charges. Additionally, there may be a separate GST rate on certain gold-relate services.

For further details access our website: https://vibrantfinserv.com