![]()

Equity Linked Savings Scheme (ELSS)

ELSS is a type of mutual fund scheme which invests primarily in equities, providing potential for higher returns over the long term. Equity Linked Savings Scheme offers tax benefits under Section 80C of the Income Tax Act, 1961 in India.

Features of ELSS:

Tax Benefits:

ELSS investments qualify for tax deductions up to ₹1.5 lakh per financial year under Section 80C of the Income Tax Act.

The amount invested in ELSS is deductible from the investor’s taxable income, reducing their overall tax liability.

Equity Exposure:

ELSS funds primarily invest in equities or equity-related instruments, offering the potential for higher returns compared to traditional tax-saving investment options like Public Provident Fund (PPF) or National Savings Certificate (NSC). However, this also entails higher risk.

Lock-in Period:

ELSS funds have a compulsory lock-in period of three years from the investment date, distinguishing it as the briefest among all tax-saving options under Section 80C.

Diversification:

ELSS funds invest in a diversified portfolio of stocks across various sectors and market capitalizations, aiming to minimize risk and maximize returns.

Liquidity:

While ELSS funds have a lock-in period of three years, they offer greater liquidity compared to other tax-saving options like PPF and NSC.

Investors can redeem ELSS units after the completion of the lock-in period.

Investment Options:

ELSS funds offer both growth and dividend options. In the growth option, returns are reinvested in the fund, leading to capital appreciation.

In the dividend option, investors receive periodic dividends from the fund.

Risk and Return:

ELSS funds carry market risk associated with equity investments.

The returns from ELSS funds are market-linked and can vary based on the performance of the underlying securities.

Professional Management:

ELSS funds are managed by experienced fund managers who make investment decisions based on thorough research and analysis of market trends and economic indicators.

Minimum Investment:

The minimum investment amount in ELSS funds varies across fund houses but is generally affordable, making it accessible to a wide range of investors.

Overall, ELSS funds offer a tax-efficient way to invest in equities while providing the potential for long-term wealth creation.

However, investors should carefully assess their risk tolerance and investment goals before investing in ELSS funds.

Visit for more information: https://www.hdfcsec.com/offering/elss

FAQs on Equity Linked Savings Scheme (ELSS):

1. What is equity linked savings scheme?

Ans: Equity Linked Savings Scheme (ELSS) is a type of mutual fund in India that offers tax benefits while primarily investing in equities. In short:

1. ELSS provides investors with the opportunity to save taxes under Section 80C of the Income Tax Act.

2. It has a lock-in period of three years, which is the shortest among tax-saving investment options.

3. ELSS invests predominantly in equities, aiming for capital appreciation over the long term.

4. It offers the potential for higher returns compared to traditional tax-saving instruments like PPF or FDs.

5. ELSS allows investors to benefit from the growth potential of the stock market while saving taxes simultaneously.

2. Equity linked savings scheme interest rate.

Ans: Equity Linked Savings Scheme (ELSS) doesn’t offer a fixed interest rate because it primarily invests in equities, which are subject to market fluctuations. Instead of interest, ELSS aims to generate returns through capital appreciation from investing in stocks.

The returns from ELSS depend on the performance of the equity markets and the fund manager’s investment decisions.

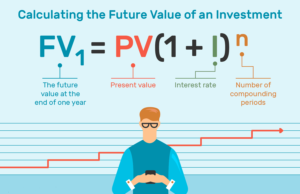

3. Equity linked savings scheme calculator.

Ans: An Equity Linked Savings Scheme (ELSS) calculator is a tool that helps investors estimate the potential returns on their ELSS investments and the tax benefits they can avail.

Basic formula to estimate the future value of your ELSS investment:

Future Value (FV) = P * (1 + r)^n

Where:

FV = Future value of investment

P = Principal amount (initial investment)

r = Expected rate of return (annualized)

n= the duration for which the investment is held.

Keep in mind that this formula provides an estimate and actual returns may vary based on market performance and other factors.

4. Equity linked savings scheme tax benefit.

Ans: Equity Linked Savings Scheme (ELSS) offers tax benefits under Section 80C of the Income Tax Act in India:

By investing in ELSS, you can avail tax deductions of up to Rs 1.5 lakh per fiscal year.

This investment amount can be deducted from the investor’s taxable income, thereby reducing their tax liability.

5. Equity linked savings scheme vs mutual fund.

Ans: Equity Linked Savings Scheme (ELSS) represents a mutual fund variant providing tax advantages under Section 80C of the Indian Income Tax Act.

Mutual Fund is a broader term encompassing various investment schemes, including ELSS, which can invest in stocks, bonds, or other assets.

ELSS specifically invests in equities and offers tax benefits, while mutual funds can have various investment objectives and may or may not offer tax benefits.

For further details access our website: https://vibrantfinserv.com