How will E-invoices help businesses to accurately file their GST compliance

How will E-invoices help businesses to accurately file their GST compliance

E-invoices can help businesses accurately file their GST (Goods and Services Tax) compliance in several ways:

1. Automation of invoice generation:

E-invoicing systems automate the process of invoice generation, which can reduce the likelihood of errors or discrepancies in the invoice. The system generates invoices in a standardized format, which makes it easier for businesses to reconcile invoices with their accounting records.

2. Real-time invoice tracking:

E-invoicing systems allow businesses to track their invoices in real-time, which can help them monitor their compliance with GST regulations. Businesses can view the status of their invoices and ensure that they are being processed correctly.

3. Reduced errors and disputes:

E-invoicing can help reduce errors and disputes in the invoicing process. Since invoices are generated automatically and transmitted electronically, there is less room for errors or misinterpretations. This can help businesses avoid disputes with their suppliers or customers and ensure that their GST compliance is accurate.

4. Faster processing of E-invoices:

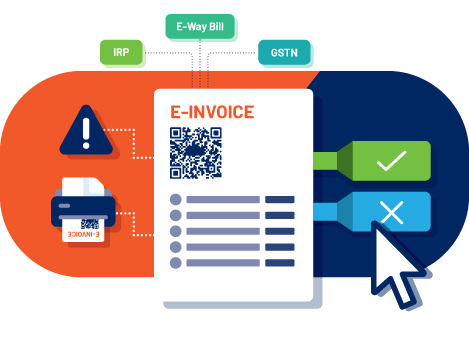

E-invoices systems enable faster processing of invoices, which can help businesses file their GST compliance on time. The system validates the invoice details and generates a unique Invoice Reference Number (IRN) in real-time, which eliminates the need for manual verification and saves time.

5. Seamless integration with GSTN:

E-invoicing systems are seamlessly integrate with the GST Network (GSTN), which enables businesses to file their GST compliance directly from the system. This eliminates the need for manual data entry and ensures that the GST returns are file accurately and on time.

Overall, e-invoicing can help businesses improve their GST compliance by automating the invoicing process, reducing errors and disputes, and enabling faster processing of invoices.

To visit: https://www.gst.gov.in/

FAQs

1.What is an E-Invoice?

- An E-Invoice is a digital invoice generated in a standardized format for reporting to the GST system. It helps in real-time invoice authentication.

2. How does E-Invoicing simplify GST filing?

- E-Invoices automatically upload data to the GST portal, reducing manual data entry and minimizing errors in filing.

3. Does E-Invoicing reduce human error?

- Yes, since data flows directly from the E-Invoice to the GST portal, it minimizes manual mistakes in reporting.

4. How does E-Invoicing improve tax accuracy?

- E-Invoices ensure real-time validation of tax details, making it easier to accurately calculate GST and avoid mismatches.

5. Will E-Invoices help in claiming Input Tax Credit (ITC)?

- Yes, E-Invoices auto-populate details in the GST return forms, making it easier to track and claim ITC accurately.

6. Does E-Invoicing reduce the risk of tax evasion?

- Yes, E-Invoicing helps prevent tax evasion by ensuring that every transaction is recorded and reported to the GST system.

7. Can E-Invoices prevent duplicate entries?

- Yes, E-Invoices are unique and validated, preventing duplication of entries in the GST filing process.

8. How does E-Invoicing save time for businesses?

- E-Invoices automate the process of uploading invoice data to the GST system, saving time in preparing and filing returns.

9. Does E-Invoicing reduce the chances of audits?

- Yes, accurate reporting through E-Invoices reduces discrepancies, thus lowering the chances of being flagged for audits.

10. Will E-Invoicing help in faster refunds?

- Since E-Invoices provide accurate and timely data to the GST system, businesses can expect quicker GST refunds due to better compliance.

For further details access our website: https://vibrantfinserv.com