User Intent

Users searching for this topic want clarity on whether every partner in a Limited Liability Partnership (LLP) needs a Digital Signature Certificate (DSC) and Director Identification Number (DIN) (or Designated Partner Identification Number (DPIN)). They may be looking for a step-by-step guide on legal requirements, applications, benefits, and limitations of DSC and DIN in an LLP. This guide will help them understand these aspects in detail.

Introduction

When forming an LLP in India, compliance with legal requirements is crucial. One of the common questions new entrepreneurs ask is whether every partner in an LLP must have a DSC and DIN/DPIN. Understanding these components is essential because they play a vital role in online authentication and business operations. In this article, we will break down the necessity of DSC and DIN for LLP partners, their benefits, limitations, and a comparative analysis to provide complete clarity.

Definition of DSC and DIN

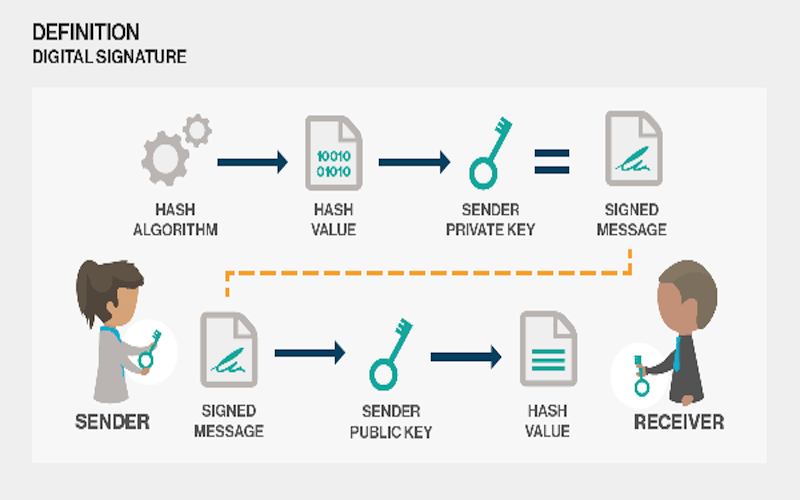

What is DSC?

A Digital Signature Certificate (DSC) is an electronic form of authentication used for filing official documents online. The Ministry of Corporate Affairs (MCA) mandates its use for LLP registration and compliance filings.

What is DIN/DPIN?

A Director Identification Number (DIN) is a unique identification number assigned to individuals who wish to become directors in companies. For LLPs, this is called a Designated Partner Identification Number (DPIN). The DPIN serves the same function as a DIN but is specifically issued for LLPs.

Application of DSC and DIN in an LLP

Step-by-Step Application Process for DSC:

- Choose a Certifying Authority: Select an authorized DSC provider approved by the Controller of Certifying Authorities (CCA) in India.

- Fill Out the Application: Submit an online application with required details like name, email ID, and PAN.

- Identity Verification: Provide identity and address proof (such as Aadhaar, PAN, or passport).

- Payment and Submission: Pay the applicable fee and submit the application.

- Download DSC: Once approved, download and install the DSC on your system.

Step-by-Step Application Process for DIN/DPIN:

- Register on the MCA Portal: Create an account on the Ministry of Corporate Affairs (MCA) website.

- File DIR-3 (for DIN) or FiLLiP (for DPIN): Fill in personal details, attach identity and address proofs, and submit the form with DSC authentication.

- Approval from MCA: After verification, MCA issues a unique DIN/DPIN.

Do All Partners in an LLP Need DSC and DIN?

- DSC is required for all designated partners who will sign documents electronically during the incorporation process.

- DPIN is mandatory only for designated partners, not for regular partners.

- Regular partners do not require DSC or DIN/DPIN unless they wish to become designated partners.

Benefits of DSC and DIN for LLP Partners

Benefits of DSC:

✔ Legally Valid: Required for online document authentication. ✔ Secure and Tamper-Proof: Ensures that documents are safe from forgery. ✔ Mandatory for MCA Filings: Essential for filing LLP-related forms online. ✔ Time-Saving: Eliminates the need for physical signatures, making processes faster. ✔ Improves Efficiency: Reduces paperwork and facilitates easy compliance.

Benefits of DIN/DPIN:

✔ Unique Identification: Provides a unique number that remains valid for a lifetime. ✔ Required for Designated Partners: Essential for LLP compliance and filings. ✔ Legally Recognized by MCA: Ensures accountability and legal recognition. ✔ Helps in Transparency: Allows tracking of designated partners in LLPs.

Limitations of DSC and DIN for LLP Partners

Limitations of DSC:

✘ Cost Involved: DSCs have validity periods and require renewal. ✘ Technical Challenges: Requires software installation and system compatibility. ✘ Mandatory Even for Minor Transactions: Even simple compliance filings need a DSC.

Limitations of DIN/DPIN:

✘ Only for Designated Partners: Regular partners cannot apply for a DPIN unless they become designated. ✘ One DIN per Individual: A person cannot have multiple DINs, which can be restrictive in case of multiple business ventures. ✘ Requires Ongoing Compliance: Failure to comply with MCA regulations can lead to deactivation.

Comparative Table: DSC vs DIN/DPIN

| Feature | DSC | DIN/DPIN |

|---|---|---|

| Purpose | Digital authentication of documents | Unique identification for designated partners |

| Required For | All designated partners filing online forms | Only for designated partners in an LLP |

| Issued By | Certifying Authorities | Ministry of Corporate Affairs (MCA) |

| Validity | 1-3 years, requires renewal | Lifetime, unless surrendered or deactivated |

| Application Process | Online through a certifying authority | Apply via DIR-3 (for DIN) or FiLLiP (for DPIN) |

| Cost Involved | Paid certificate, varies by provider | One-time MCA fee |

| Legal Requirement | Mandatory for online compliance filings | Mandatory for designated partners |

Conclusion

To sum up, not all partners in an LLP require DSC and DIN/DPIN. Only designated partners must have both for compliance purposes. While DSC ensures secure digital authentication, DIN/DPIN provides a unique identity to designated partners. Regular partners are not obligated to obtain these unless they take up the role of designated partners. Understanding these requirements helps LLP partners streamline their legal compliance and business operations effectively.

FAQs

1. Can a regular partner in an LLP get a DIN/DPIN?

No, only designated partners require a DPIN. Regular partners do not need one unless they are appointed as designated partners.

2. Can a single DSC be used for multiple LLPs?

Yes, a DSC issued to an individual can be used for multiple LLPs, as long as the person is authorized to sign documents.

3. What happens if a designated partner does not obtain a DPIN?

Without a DPIN, a person cannot act as a designated partner in an LLP.

4. How long does it take to obtain DSC and DPIN?

Typically, DSC issuance takes 1-3 days, while DPIN approval can take 2-7 days, depending on MCA processing.

5. Is a DSC mandatory for all LLP filings?

Yes, all designated partners must use DSC for digital filings with the MCA.

For further details access our website: https://vibrantfinserv.com