Introduction

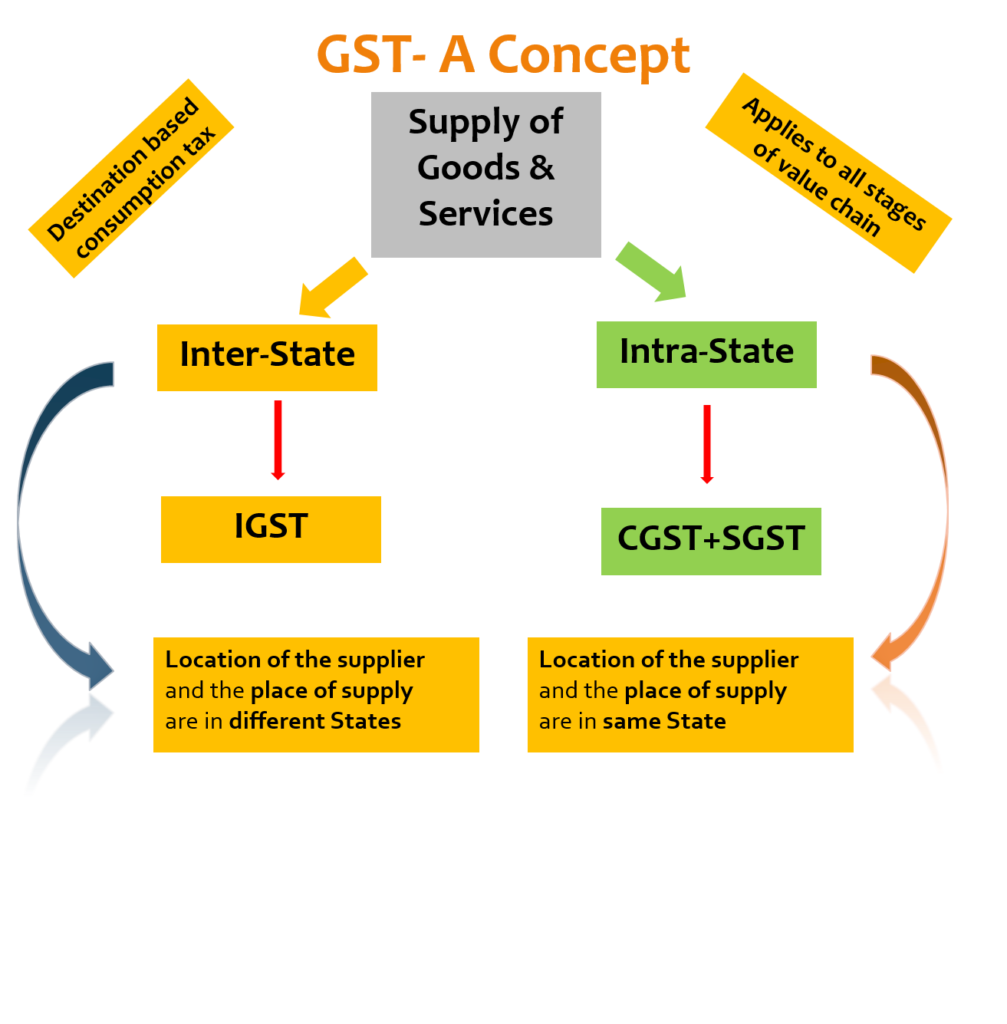

What does it mean when we say GST is a destination based tax? Goods and Services Tax (GST) is a revolutionary tax reform that has streamlined indirect taxation in many countries, including India.

One of its key features is that it is a “destination-based tax.

” This means that the government levies tax at the point of consumption rather than the point of origin. Understanding this concept is crucial for businesses, consumers, and policymakers alike.

Definition of GST as a Destination-Based Tax

In a destination-based tax system, the state that finally consumes the goods or services collects the GST revenue. Unlike an origin-based tax system, where the state producing the goods collects the tax, GST ensures that the state of the end consumer benefits from the taxation.

For example, if a retailer in Karnataka purchases goods from a manufacturer in Maharashtra, Karnataka receives the tax revenue since the consumption occurs there.

Application of Destination-Based GST

- Interstate Transactions – Under the Integrated G S T (IGST) framework, the government credits the tax collected on interstate sales to the destination state.

- For intrastate transactions -Both the central and state governments levy C GST and S GST, while the state collects S GST where goods or services are consumed.

- Imports – The destination state collects GST on imported goods and services at the point of entry into the country.

User Intent Behind GST as a Destination-Based Tax

Governments worldwide implement destination-based taxation to create a fair and transparent tax structure. The objective is to eliminate cascading taxes, improve tax compliance, and ensure that tax revenue is distributed equitably among consuming states.

Benefits of GST as a Destination-Based Tax

- Elimination of Cascading Effect – Tax is imposed only at the point of final consumption, reducing multiple tax layers.

- Fair Revenue Distribution – The consuming state receives the tax, ensuring equitable development.

- Encouragement of Production Efficiency – Since taxation does not cause production states to lose out, manufacturers focus on efficiency rather than tax benefits.

- Simplified Tax Compliance – Uniform tax rates and structured collection reduce compliance burdens.

- Enhanced Transparency – Uniform tax laws across states create a transparent tax system.

- Boosts Economy – Encourages interstate trade and investment by eliminating tax barriers.

- Reduces Tax Evasion – Centralized monitoring and uniform tax rates deter tax evasion.

Usage of GST as a Destination-Based Tax

- Business Transactions – Businesses must register for GST and charge it based on the place of consumption.

- E-commerce – Online sellers must apply GST based on the buyer’s location.

- Import and Export – GST is applied to imported goods at the destination, while exports are zero-rated.

- Service Industry – Service providers must apply GST based on the location of the recipient.

- Real Estate Transactions – GST applies based on the property’s location, benefiting the consuming state.

Limitations of Destination-Based GST

- Implementation Challenges – Ensuring compliance across states can be complex.

- Administrative Burden – Businesses must track consumption locations accurately.

- Revenue Dependency – Some states with lower consumption may face revenue deficits.

- Complexity in Interstate Trade – IGST collection and distribution require efficient administration.

- Initial Adjustment Period – Transitioning from origin-based taxation posed difficulties for businesses.

Cooperative Table: Origin-Based vs. Destination-Based Taxation

| Aspect | Origin-Based Taxation | Destination-Based Taxation |

|---|---|---|

| Tax Collection | Collected in the producing state | Collected in the consuming state |

| Fairness | Benefits producer states | Benefits consumer states |

| Economic Impact | Can create imbalances | Promotes uniform development |

| Complexity | Multiple layers of taxation | Streamlined taxation |

| Business Implication | Encourages tax-motivated relocation | Focuses on efficiency |

Conclusion

GST, as a destination-based tax, ensures revenue collection at the point of final consumption, promoting economic fairness and eliminating inefficiencies in the taxation system. While it presents some implementation challenges, this vital reform in modern taxation boosts trade, enhances transparency, and increases state revenues in the long run. Businesses and consumers alike benefit from a unified and structured tax regime that aligns with global best practices.

FAQs

-

What is a destination-based tax?

- The state collects a tax where goods or services are consumed rather than produced.

- Although implementing this vital reform in modern taxation poses some challenges, in the long run, it ultimately boosts trade, enhances transparency, and increases state revenues.

- The state collects the tax where goods or services are consumed rather than where they are produced.

- How does IGST work in destination-based taxation?

- IGST applies to interstate transactions, with tax collected centrally and transferred to the consuming state.

- Does GST apply to imports?

- Yes, GST is levied at the point of entry, benefiting the destination state.

- How does GST impact businesses in producing states?

- While businesses do not receive tax revenue they benefit from a uniform tax system and incur lower compliances costs.

- What are the challenges of destination-based GST?

- Implementation complexity, revenue dependency on consumption patterns, and tracking compliance.

- Does GST apply to services the same way?

- Yes, service GST is levied based on the recipient’s location.

- How does GST benefit consumers?

- It eliminates double taxation, reduces prices, and ensures fair tax distribution.

- Which country follows destination-based taxation?

- Many countries, including India, Canada, and Australia, follow this system.

- Is GST beneficial for all states?

- High-consumption states gain more benefit but the compensation mechanism helps balance disparities.

For further details access our website https://vibrantfinserv.com/

To visit: https://www.mca.gov.in/

Contact: 8130555124, 8130045124

Whatsapp: https://wa.me/918130555124

Mail ID: operations@vibrantfinserv.com

Web Link: https://vibrantfinserv.com

FB Link: https://fb.me/vibrantfinserv

Insta Link: https://www.instagram.com/vibrantfinserv2/