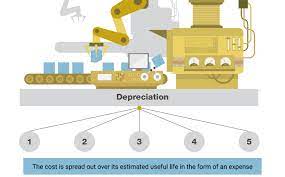

Depreciation Value

The depreciation value of vehicles and equipment refers to the gradual decrease in their worth over time due t factors such as wear and tear, obsolescence, and aging.

It’s a crucial concept in accounting and finance as it helps organizations allocate the cost of these assets over their useful lives.

To calculate depreciation, various methods can be use, including straight-line depreciation, declining balance depreciation, and units of production depreciation.

The choice of method depends on factors like the asset’s expected useful life and the rate at which it loses value.

By properly accounting for depreciations, businesses can accurately reflect the diminishing value of their assets on their financial statements, which in turn affects their profitability, tax liabilities, and decision-making processes.

It’s essential to consult with financial experts or accountants to determine the appropriate method and rates for calculating the depreciation value of vehicles and equipment based on your specific circumstances.

To visit: https://www.mca.gov.in/