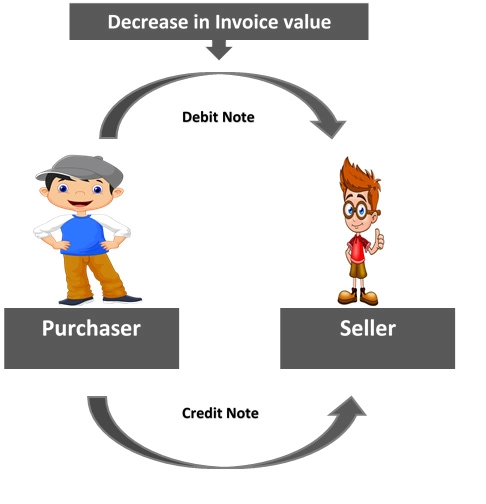

Debit invoice vs credit invoice, A debit invoice and a credit invoice are two types of documents used in accounting to record financial transactions. They have distinct characteristics and implications:

Debit Invoice

A debit invoice is a document issued by a supplier to a buyer when additional goods or services are provided, or when the value of the originally supplied goods or services is increase. It serves to record the upward adjustment in the transaction and reflects the updated amount owed by the buyer to the supplier. The debit invoice acts as a formal notification of the added goods or services and helps maintain accurate financial records or services is increase. It results in an augment amount owed by the buyer to the supplier.

Credit invoice

Conversely, a credit invoice is issue by a supplier to a buyer when the value of the originally supplied goods or services is reduce, or when the buyer is entitle to a refund. It leads to a reduce amount owed by the buyer to the supplier.

In essence, the main difference between a Debit invoice vs credit invoice lies in their impact on the amount owed by the buyer to the supplier. A debit invoice increases the outstanding balance, while a credit invoice decreases it. These distinctions are crucial for accurate financial recording and tracking of transactions in the accounting process.

To visit: https://www.gst.gov.in/

FAQs

1. What is a Debit Invoice?

Ans: A debit invoice is issue by a seller to increase the amount owed by a buyer, typically for additional services or products not covered in the original invoice.

2. What is a Credit Invoice?

Ans: A credit invoice is issue by a seller to reduce the amount owed by a buyer, usually due to a return, discount, or overcharge.

3. When is a Debit Invoice Used?

Ans: A debit invoice is use when the buyer needs to pay more than the original invoice, such as for extra goods or services delivered after the initial transaction.

4. When is a Credit Invoice Use?

Ans: A credit invoice is use when the buyer has been overcharged or returns goods, and the seller needs to reduce the original amount owed.

5. Does a Debit Invoice Increase or Decrease the Amount Owed?

Ans: A debit invoice increases the amount the buyer owes to the seller.

6. Does a Credit Invoice Increase or Decrease the Amount Owed?

Ans: A credit invoice decreases the amount the buyer owes to the seller.

7. Can Both Invoices Be Use in the Same Transaction?

Ans: Yes, both debit and credit invoices can be issue for the same transaction if adjustments are needed for both increasing and decreasing amounts.

8. How Does a Debit Invoice Affect the Seller’s Account?

Ans: A debit invoice adds to the seller’s accounts receivable, meaning the buyer owes more.

9. How Does a Credit Invoice Affect the Seller’s Account?

Ans: A credit invoice reduces the seller’s accounts receivable, meaning the buyer owes less.

10. Which Invoice Is Issued for Returns?

Ans: A credit invoice is issue when goods are return by the buyer, lowering the total amount owed.

For further details visit: https://vibrantfinserv.com/

Contact: 8130555124, 8130045124

Whatsapp: https://wa.me/918130555124

Mail ID: operations@vibrantfinserv.com

FB Link: https://fb.me/vibrantfinserv

Insta Link: https://www.instagram.com/vibrantfinserv2/

Twitter: https://twitter.com/VibrantFinserv

Linkedin: https://www.linkedin.com/in/vibrant-finserv-62566a259/