![]()

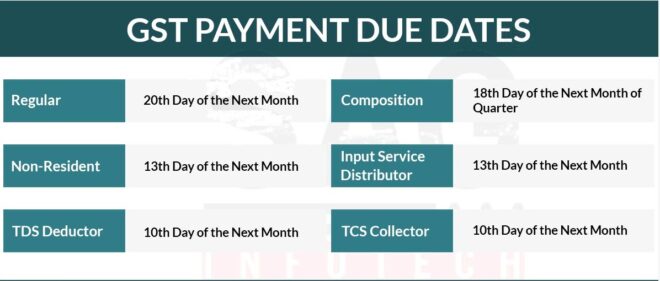

Deadlines for GST Tax Payments

The specific deadlines for GST tax payments vary based on the taxpayer’s category and the frequency of their filinga Here are some general guidelines for GST tax due dates in India:

Monthly GST Return Filers: For businesses that file their GST returns on a monthly basis, the tax due date is generally the 20th of the following month.

For example, the tax due for the month of January would typically be due by the 20th of February.

Quarterly GST Return Filers: For businesses that opt for quarterly filing of GST returns, the tax due date is usually the 22nd or 24th of the month following the end of the quarter.

For example, if the quarter ends on 31st March, the tax due date would be 22nd or 24th April.

It’s important to note that these dates are subject to change, and it’s advisable to refer to the official GST portal (www.gst.gov.in) or consult with a tax professional to determine the specific tax due dates applicable to your business and the latest updates. Non-compliance with tax payment deadlines may result in penalties or interest charges.

For further details access our website https://vibrantfinserv.com