Credit Note without GST Charges

Credit Note without GST Charges

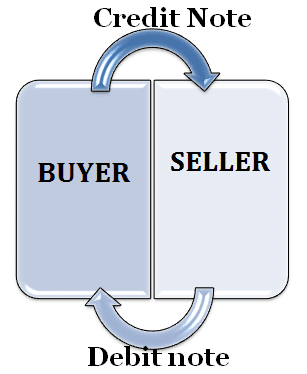

Credit note without GST charges, Yes, a supplier can issue a credits note without GST charge under certain circumstances. A credit note is typically issue to adjust or rectify an incorrect invoice or to provide a refund to the buyer.

If the original invoice did not include Good and service Tax charges, the credit note issued in relation to that invoice would also not include Good and service Tax charges. However, it is important to comply with the applicable tax laws and regulations of the jurisdiction to ensure accurate documentation and reporting of the transaction.

It is advisable to consult with a tax professional or refer to the official guidelines to determine the specific requirements regarding credit notes and GST charge in your jurisdiction.

To visit: https://www.gst.gov.in/

For further details access our website: https://vibrantfinserv.com