45. What is the threshold limit and due date of tax audit report for Automobile Dealers?

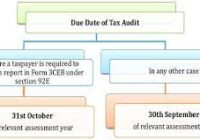

Tax Audit Report for Automobile Tax Audit Report for Automobile dealers stands at Rs. 10 crore, provided that cash transactions remain below 5% of the total transactions. This means that if an automobile dealer’s total turnover during a financial year is Rs. 10 crore or more, and if the cash receipts and cash payments do… Read More »