LLP is created by ?

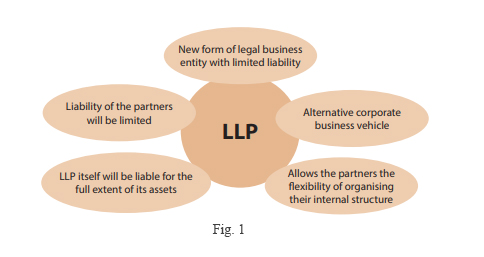

LLP is created by A Limited Liability Partnership (LLP) is created by following the prescribed legal procedures and fulfilling the requirements set forth by the governing authority in the respective jurisdiction. The process of creating an LLP typically involves the following steps: 1. Name Reservation: Choose a unique name for the LLP and check its… Read More »