What tax deductions are available for Automotive Repair Services during ITR filing?

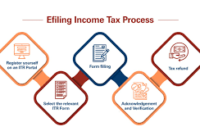

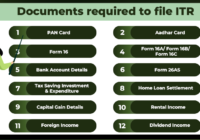

ITR for Automotive Repair Services When filing your ITR for Automotive Repair Services, there are several tax deductions you can consider. 1. Business Expenses Deduction: You can claim deductions for various business-related expenses incurred in providing automotive repair services. This includes expenses such as tools, equipment, spare parts, and salaries of technicians. These expenses… Read More »