What HUF means?

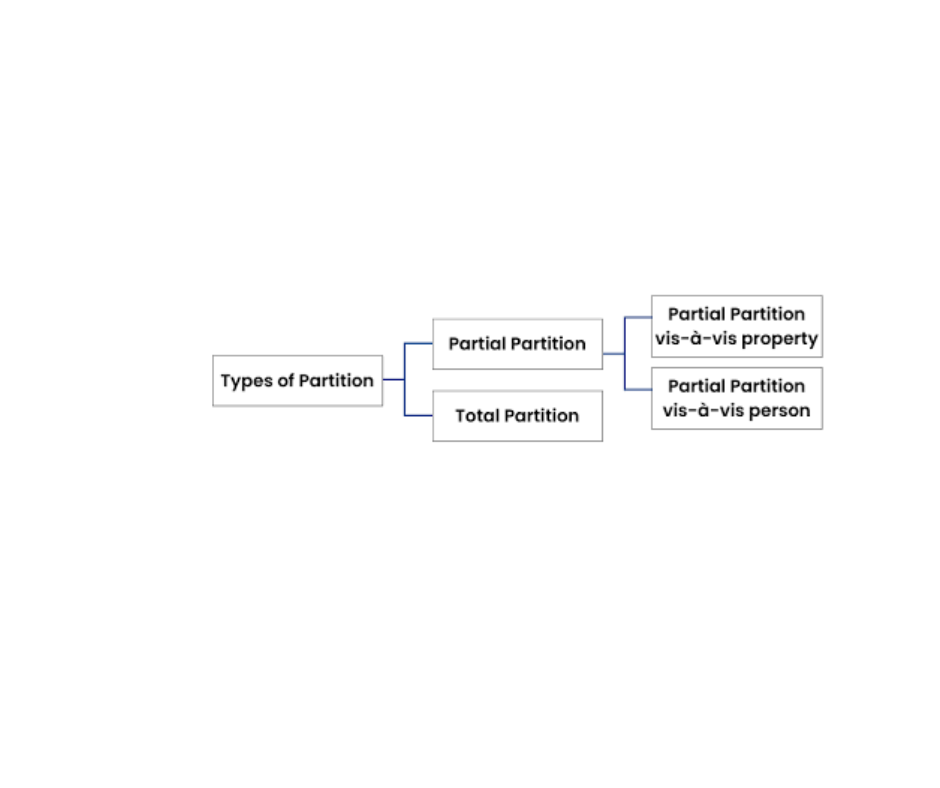

HUF Means In an HUF, family members are lineally descended from a common ancestor and live together as a joint family, sharing common rights, obligations, and property. The family is governed by the Hindu law and follows the principles of Hindu family customs and traditions. HUFs have certain legal and tax implications. They… Read More »