There are any threshold limit of bookkeeping for Electrical Items Sales & Services?

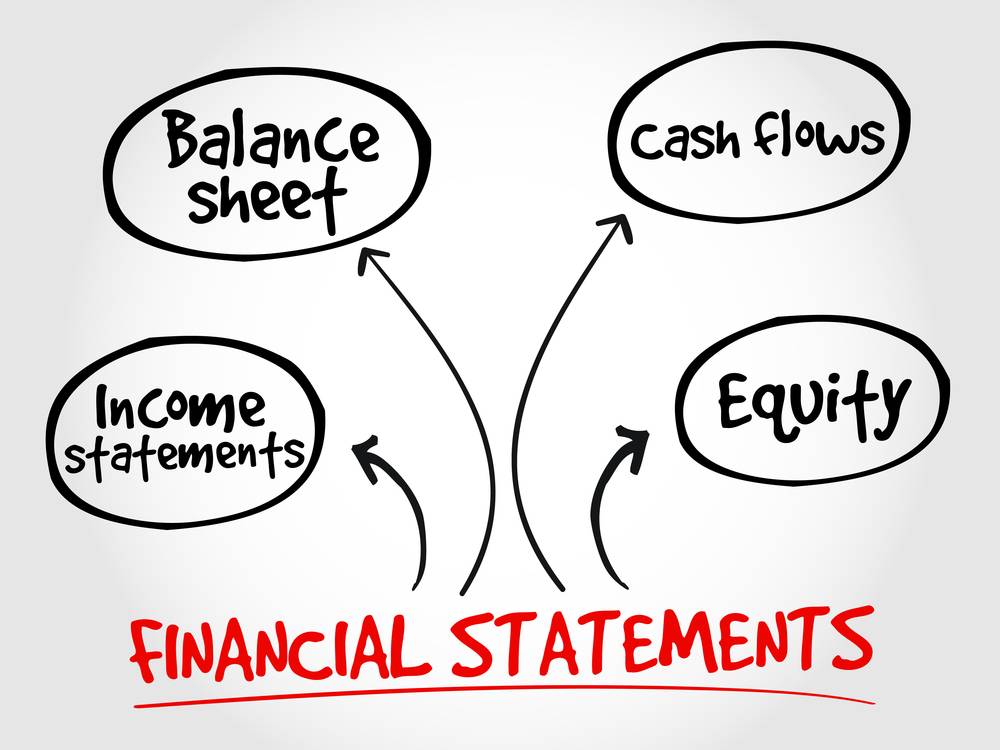

Bookkeeping Basics Absolutely, there exist specific thresholds concerning bookkeeping basics within the realm of electrical items sales and services. In the United Kingdom, when your business surpasses a taxable turnover of £85,000 in the preceding fiscal year, you are obligated by law to maintain comprehensive documentation of all financial transactions associated with your business… Read More »