User Intent

Many business owners, accountants, and freelancers struggle to determine how much Goods and Services Tax (GST) is included in their total receipts. Understanding how to extract GST from the total amount is essential for financial accuracy, compliance, and tax reporting. This guide provides a step-by-step approach to calculating the GST portion in total receipts with easy-to-follow formulas.

Introduction

When dealing with sales receipts that include GST, businesses must separate the tax component to ensure proper accounting. Calculating GST accurately helps in tax reporting, refund claims, and cost management. Whether you are a small business owner, a freelancer, or an accountant, knowing how to extract GST from a total amount will streamline your financial processes.

This article will break down the concept of GST, its application, benefits, limitations, and provide a comparative analysis for clarity. Additionally, we will answer frequently asked questions to address common concerns.

Definition

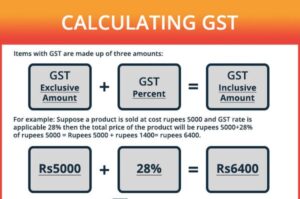

GST (Goods and Services Tax) is a consumption-based tax levied on the sale of goods and services. In many countries, businesses must include GST in their pricing structure.

For example, if a business sells a product for $110 (including 10% GST), the price already consists of the tax amount. The goal is to determine the GST portion and the net amount before tax.

Formula to Calculate GST from Total Receipts:

For example, if the total price is $110 and the GST rate is 10%:

Application

Understanding how to calculate GST in different scenarios helps in managing cash flow and tax compliance. Here are a few practical applications:

- Retail Businesses – Extracting GST from receipts ensures proper reporting and correct pricing for tax-inclusive sales.

- Service Providers – Freelancers and consultants use GST calculations to determine tax liability.

- Accounting & Bookkeeping – Accountants separate GST to maintain financial records and prepare tax returns.

- E-commerce – Online sellers must accurately extract GST to report sales correctly.

- Tax Returns & Refunds – Businesses claiming GST credits need to determine the exact tax component from total invoices.

Benefits

- Tax Compliance – Properly extracting GST ensures compliance with tax laws, preventing penalties.

- Accurate Financial Reporting – Helps in maintaining clear financial statements.

- Improved Cash Flow Management – Businesses can manage their working capital efficiently.

- Better Pricing Strategy – Understanding the GST component helps in setting competitive prices.

- Claiming GST Credits – Businesses can recover the correct amount of input tax credits.

Limitations

- Complexity in Multiple Tax Rates – Some businesses deal with varying GST rates, making calculations more complex.

- Rounding Errors – Minor rounding issues can occur when extracting GST from large amounts.

- Currency Fluctuations – For international transactions, currency changes can affect GST calculation.

- Manual Errors – Incorrect application of formulas may lead to miscalculations.

- Non-GST-Registered Entities – Businesses that are not GST-registered cannot extract or claim GST credits.

Comparative Table

| Scenario | Total Price (Incl. GST) | GST Rate | GST Amount | Net Price |

|---|---|---|---|---|

| Product Sale | $220 | 10% | $20 | $200 |

| Service Invoice | $550 | 5% | $26.19 | $523.81 |

| Restaurant Bill | $330 | 8% | $24.44 | $305.56 |

| Online Subscription | $99 | 7% | $6.49 | $92.51 |

| Exported Goods (GST-Free) | $500 | 0% | $0 | $500 |

Conclusion

Understanding how to calculate the GST portion from total receipts is vital for tax compliance and financial accuracy. Whether for small businesses, freelancers, or large enterprises, properly extracting GST ensures accurate bookkeeping and tax reporting. Using the formulas and methods discussed in this article, businesses can confidently handle their GST calculations.

Frequently Asked Questions (FAQs)

- How do I extract GST from total receipts?

- Use the formula:

- What if my business is not registered for GST?

- If you are not registered, you cannot charge or claim GST.

- Can I claim back GST on expenses?

- Yes, if your business is GST-registered, you can claim input tax credits.

- Is GST the same in all countries?

- No, GST rates and rules vary by country.

- What happens if I miscalculate GST?

-

Incorrect GST calculations can lead to tax penalties or financial discrepancies.

-

To visit: https://services.gst.gov.in

For further details access our website: https://vibrantfinserv.com