Business Licenses for Taxes Yes, business licenses generally required in Texas for many types of businesses. However, the specific licenses and permits needed can vary depending on the nature of the business and the location where it operates.

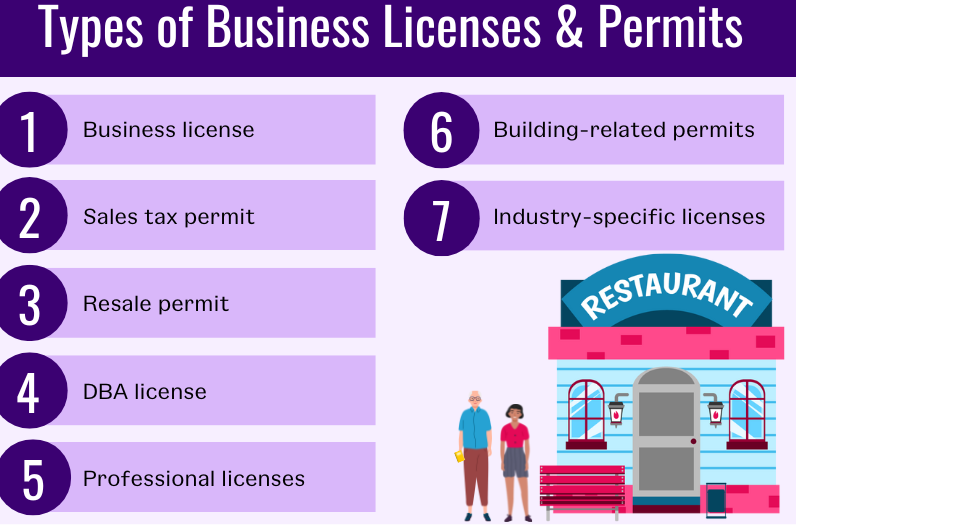

Some common examples of licenses and permits required in Texas include:

1. General Business License:

Most businesses in Texas are requir to obtain a general business license, also known as a “business tax certificate” or “assumed name certificate.” This license obtained at the county level and is necessary for operating a business under a name other than the legal name of the owner. Are business licenses required in taxes.

2. Professional Licenses:

Certain professions and occupations in Texas, such as doctors, lawyers, engineers, contractors, and others, may require specific professional licenses or certifications. These licenses are issued by state regulatory agencies and are necessary to legally practice in those professions.

3. Industry-Specific Licenses:

Some industries in Texas have specific licensing requirements. For example, businesses involved in selling alcohol, operating daycares, providing healthcare services, or operating certain types of food establishments may need additional licenses or permits specific to their industry.

4. Local Permits:

Depending on the city or county where the business operates, there may be additional local permits or licenses required. These can include zoning permits, health permits, signage permits, and more.

It’s important to research the specific licensing requirements for your type of business and location in Texas. You can visit the Texas Secretary of State website, the Texas Department of Licensing and Regulation, or contact your local city or county government offices to get more information and guidance on the licenses and permits you may need to operate your business legally in Texas.

FAQs:

To visit: https://msme.gov.in/

For further details access our website https://vibrantfinserv.com