Bookkeeping and Accounting

Bookkeeping and Accounting

Introduction

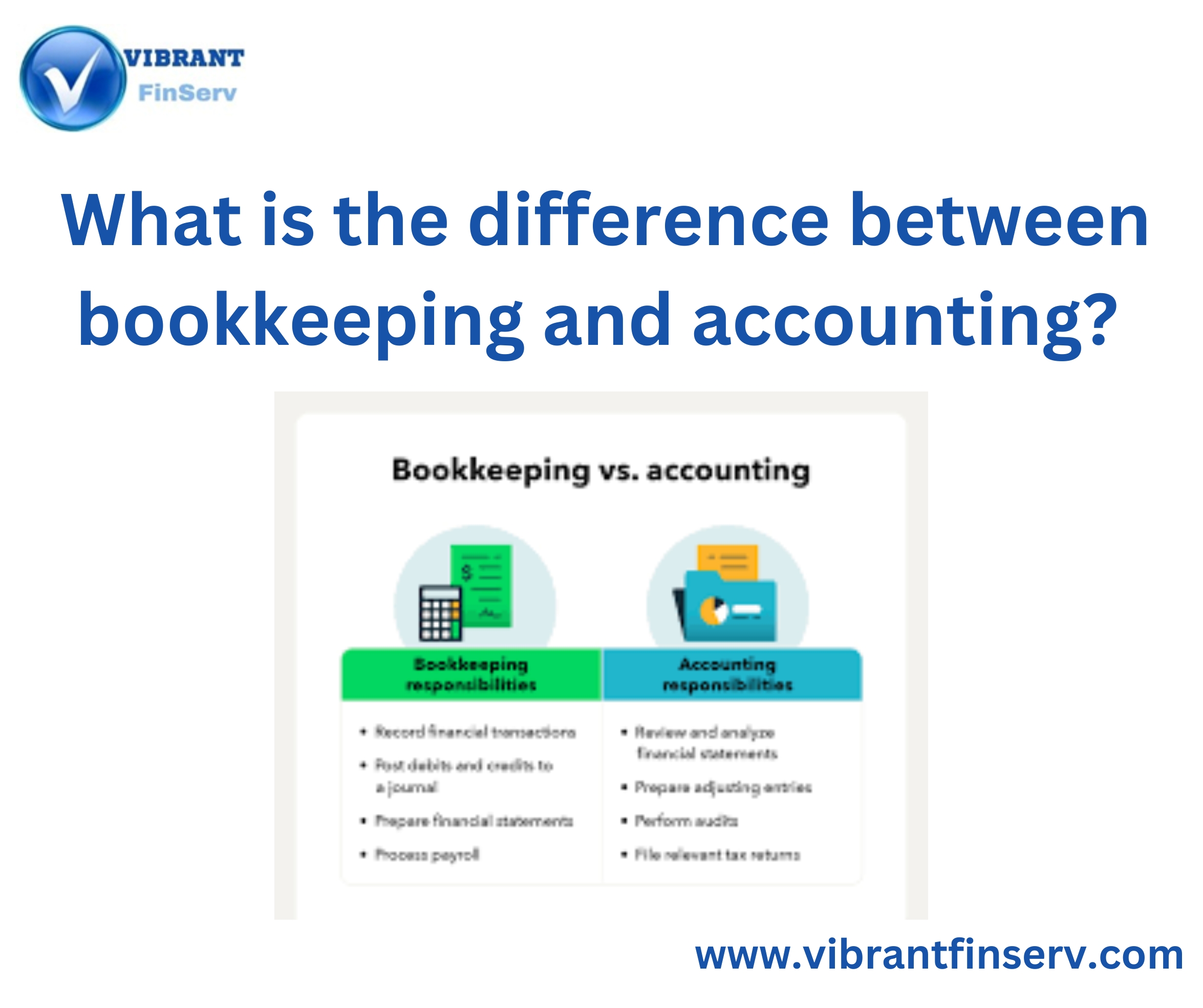

Bookkeeping and accounting are two essential functions in financial management that often overlap but serve different purposes. While bookkeeping involves recording financial transactions systematically, accounting focuses on analyzing, summarizing, and interpreting financial data for decision-making. Understanding the differences between these two functions is crucial for businesses and individuals who want to manage their finances effectively.

Definition of Bookkeeping and Accounting

- Bookkeeping: The process of recording financial transactions systematically, ensuring that all financial data is accurate and organized.

- Accounting: The broader process of interpreting, analyzing, summarizing, and reporting financial data based on bookkeeping records.

Application of Bookkeeping and Accounting

- For Small Businesses ã Helps maintain financial records, track expenses, and prepare tax filings.

- For Large Corporations ã Ensures compliance with financial regulations and aids in strategic planning.

- For Individuals ã Assists in budgeting, managing personal expenses, and preparing tax returns.

- For Government Agencies ã Helps in public fund management and financial auditing.

User Intent: Why Understand Bookkeeping vs. Accounting?

- To choose the right financial management approach for a business or personal needs.

- To decide whether to hire a bookkeeper or an accountant.

- To understand financial statements and reports effectively.

- To ensure compliance with tax laws and regulations.

Benefits of Bookkeeping

- Accurate Financial Records ã Ensures that all transactions are recorded systematically.

- Easier Tax Preparation ã Provides a clear record of income and expenses.

- Budget Management ã Helps businesses track expenses and revenue.

- Improved Cash Flow Management ã Keeps track of accounts receivable and payable.

- Prevents Financial Discrepancies ã Reduces errors and fraud in financial data.

Benefits of Accounting

- Informed Decision-Making ã Provides insights into financial health.

- Compliance with Regulations ã Ensures adherence to tax laws and financial standards.

- Strategic Planning ã Helps businesses set goals and forecast future financial performance.

- Financial Reporting ã Prepares balance sheets, income statements, and cash flow statements.

- Cost Management ã Helps in identifying areas where costs can be reduced.

Usage of Bookkeeping and Accounting

- Bookkeeping is used for: Recording transactions, managing payroll, reconciling bank statements, tracking invoices.

- Accounting is used for: Analyzing financial reports, preparing budgets, forecasting financial trends, ensuring regulatory compliance.

Limitations of Bookkeeping

- Lack of Analysis ã Does not provide insights into financial performance.

- Limited Decision-Making Support ã Only records transactions without interpreting them.

- May Not Meet Regulatory Requirements ã Insufficient for complex financial reporting needs.

Limitations of Accounting

- Time-Consuming ã Requires significant effort to analyze and interpret financial data.

- Requires Expertise ã Needs knowledge of financial principles and regulations.

- Higher Costs ã Hiring professional accountants can be expensive.

Comparative Table: Bookkeeping vs. Accounting

| Feature | Bookkeeping | Accounting |

|---|---|---|

| Purpose | Recording financial transactions | Analyzing and interpreting financial data |

| Complexity | Simple and procedural | Complex and analytical |

| Decision-Making | Limited role | Crucial for financial strategy |

| Regulatory Compliance | Not always sufficient | Ensures legal and tax compliance |

| Required Skills | Basic financial knowledge | Advanced financial expertise |

| Tools Used | Spreadsheets, bookkeeping software | Accounting software, financial analysis tools |

| Financial Statements | Not prepared | Prepared and analyzed |

Conclusion

While bookkeeping and accounting are interrelated, they serve distinct purposes. Bookkeeping is essential for maintaining accurate financial records, while accounting helps in financial analysis and decision-making. Businesses and individuals must understand the differences to manage their finances effectively and ensure compliance with financial regulations.

10 Frequently Asked Questions (FAQs)

- What is the primary difference between bookkeeping and accounting?

- Bookkeeping records financial transactions, whereas accounting analyzes and interprets them.

- Do small businesses need both bookkeeping and accounting?

- Yes, bookkeeping helps in record-keeping, while accounting aids in financial planning and compliance.

- Can bookkeeping be automated?

- Yes, bookkeeping software can automate transaction recording and financial reconciliation.

- Is an accountant the same as a bookkeeper?

- No, accountants provide financial analysis and compliance services, while bookkeepers handle transaction recording.

- Which is more critical for financial decision-making?

- Accounting, as it provides insights into financial health and performance.

- Does bookkeeping require formal education?

- Not necessarily, but knowledge of financial principles is helpful.

- Can businesses do without accounting?

- No, accounting is essential for financial reporting, tax compliance, and strategic planning.

- How do bookkeeping and accounting work together?

- Bookkeeping provides the raw financial data, which accountants analyze and interpret.

- What software is commonly used for bookkeeping and accounting?

- Bookkeeping: QuickBooks, Xero, Wave

- Accounting: SAP, Oracle, FreshBooks

- How can a business choose between hiring a bookkeeper or an accountant?

- If the primary need is recording transactions, a bookkeeper is sufficient. If financial analysis and compliance are required, an accountant is necessary.

For more information visit this site: https://www.incometax.gov.in

For further details access our website https://vibrantfinserv.com/

To visit: https://www.mca.gov.in/

Contact:ô ô ô ô 8130555124, 8130045124

Whatsapp:ô ô https://wa.me/918130555124

Mail ID:ô ô ô ô ô ô operations@vibrantfinserv.com

Web Link:ô ô ô https://vibrantfinserv.com

FB Link:ô ô ô ô ô ô https://fb.me/vibrantfinserv

Insta Link:ô ô https://www.instagram.com/vibrantfinserv2/

Twitter:ô ô ô ô ô ô https://twitter.com/VibrantFinserv

To visit: https://www.mca.gov.in