Bookkeeping Accounting Principles are closely intertwine terms that encompass the meticulous documentation, arrangement, and communication of financial transactions and data for a business or organization.

Despite their interconnections, these two concepts hold separate significance.

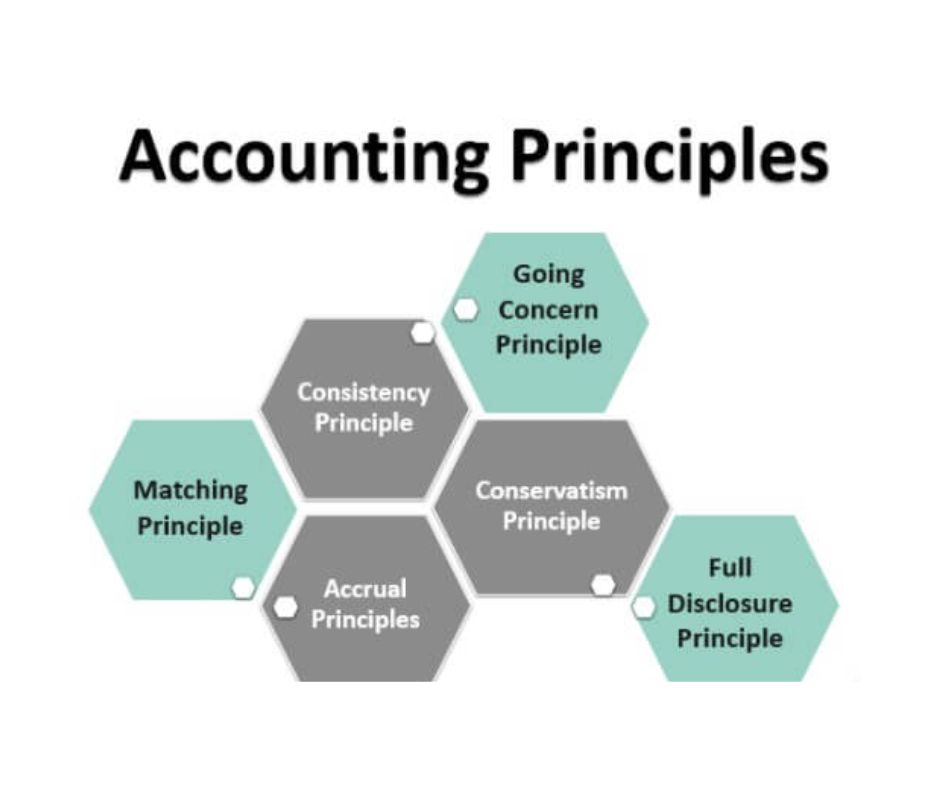

Going Concern Principle:

This principle assumes that a business will continue its operations in the foreseeable future. It implies that financial statements are prepare with the assumption that the business will continue to operate and fulfil its obligations.

Accrual Principle:

According to this principle, revenue and expenses should be recognize when they are earn or incur, regardless of when the cash is received or paid. It ensures that financial statements reflect the economic reality of transactions.

Matching Principle:

This principle states that expenses should be match with the revenues they generate in the same accounting period. It ensures that the income statement accurately reflects the profitability of the business.

Historical Cost Principle:

This principle states that assets should be record at their original cost when acquire, rather than at their current market value. Exceptions to this principle include certain financial instruments and investments that are require to be measure at fair value.

Consistency Principle:

This principle requires that accounting methods and practices remain consistent over time. It ensures comparability and allows for meaningful analysis and interpretation of financial information.

Materiality Principle:

According to this principle, financial information should be report if its omission or misstatement could influence the decision-making process of users. It allows for reasonable judgement in determining what information is significant enough to be include in the financial statements.

Conservatism Principle:

This principle suggests that when there is uncertainty or doubt, accountants should err on the side of caution and recognize potential losses or liabilities rather than potential gains. It prevents the overstatement of assets and income.

Bookkeeping Accounting Principles:

These principles, along with other accounting guidelines and standards (such as Generally Accepted Accounting Principles or International Financial Reporting Standards), provide a framework for accurate and reliable financial reporting. It’s important for bookkeepers and accountants to adhere to these principles to ensure the integrity of financial information.

To visit https://www.mca.gov.in

FAQs