Benefit of GST number

Benefit of GST number

Benefit of GST number: Introduced on July 1, 2017, the Goods and Services Tax (GST) is a comprehensive indirect tax implemented in India. Under the GST regime, businesses are assigned a unique identification number known as the GST number. This 15-digit alphanumeric code plays a vital role in tracking the business’s transactions and ensuring adherence to GST regulations.

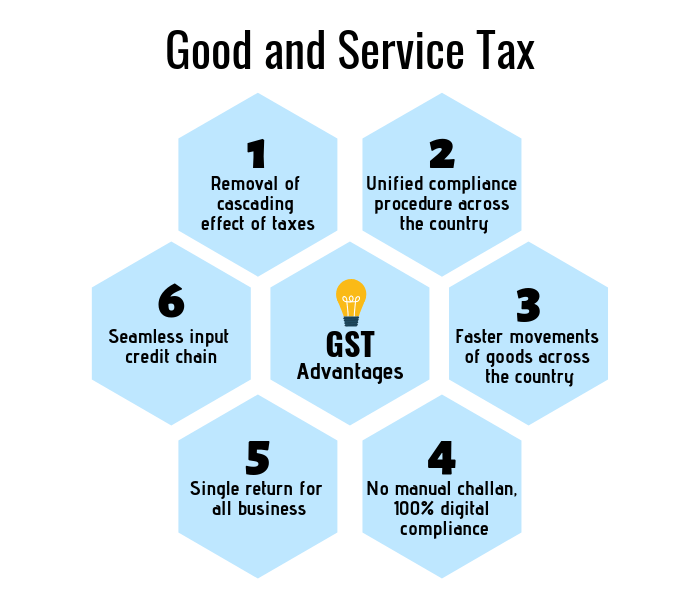

There are several advantages to obtaining a GST number:

- Legal recognition: GST registration is mandatory for businesses with an annual turnover exceeding Rs. 20 lakhs (or Rs. 10 lakhs for special category states). Acquiring a GST number grants legal recognition to the business, allowing it to operate legitimately within India.

- Input tax credit: GST is applicable at every stage of the supply chain. By registering under GST, businesses become eligible to claim input tax credit on the GST paid for their purchases. This enables them to reduce their tax liability and improve their cash flow.

- Compliance with regulations: Registered businesses must adhere to GST regulations, which involve filing timely GST returns and making prompt GST payments. Non-compliance can result in penalties and fines. Having a GST number assists businesses in remaining compliant with the regulations and avoiding penalties.

Competitive advantage: GST registration provides businesses with a competitive edge over those that are unregistered. It signals that the business is a credible and trustworthy entity, which can attract customers and enhance its reputation.

Competitive advantage: GST registration provides businesses with a competitive edge over those that are unregistered. It signals that the business is a credible and trustworthy entity, which can attract customers and enhance its reputation.- Benefit of GST number: In summary, the key benefits of obtaining a GST number include legal recognition, eligibility for input tax credit, compliance with GST regulations, and a competitive advantage.

To Visit: https://www.gst.gov.in/

For further details access our website https://vibrantfinserv.com