Assets and Liabilities on BalanceSheet

Architectural companies arrange their Assets and Liabilities on BalanceSheet to offer an overview of their financial status and standing at a particular moment point in time.

Here’s how architectural firms typically categorize their assets and liabilities on a balance sheet:

♦ Assets:

1. Current Assets:

These are assets that are expect to be convert into cash or used up within a year. Examples include:

2. Cash and Cash Equivalents:

This includes cash on hand, in bank accounts, and short-term investments.

3. Accounts Receivable:

Amounts owed to the firm by clients for services rendered.

4. Prepaid Expenses:

Payments made in advance for expenses like rent, insurance, etc.

5. Inventory:

Materials or supplies that are held for future use in architectural projects.

6. Non-Current Assets (Long-Term Assets):

These are assets expected to be held for more than a year.

7. Property, Plant, and Equipment:

The value of buildings, office equipment, computers, and other tangible assets used in the firm’s operations.

8. Intangible Assets:

Non-physical assets like patents, copyrights, trademarks, or goodwill.

9. Investments:

Any long-term investments made by the firm, such as shares in other companies or long-term bonds.

♦ Liabilities:

1. Current Liabilities:

Debts and obligations that are expected to be settled within a year.

2. Accounts Payable:

Money owed by the firm to suppliers and vendors for goods and services.

3. Short-Term Loans:

Loans or credit lines that need to be repaid within a year.

4. Accrued Liabilities:

Expenses that have been incurred but not yet paid, like salaries or taxes.

5. Non-Current Liabilities (Long-Term Liabilities):

Debts and obligations expected to be settled over a period longer than a year.

6. Long-Term Loans:

Loans with a repayment period exceeding one year.

7. Deferred Tax Liability:

Taxes that will be due in future periods based on current financial statements.

8. Lease Obligations:

Long-term lease agreements for office space or equipment.

9. Equity:

Also known as owner’s equity or shareholders’ equity, this represents the residual interest in the firm’s assets after deducting liabilities. It includes:

10. Common Stock:

The value of shares issued to owners or shareholders.

11. Retained Earnings:

Accumulated profits that have not been distributed to shareholders.

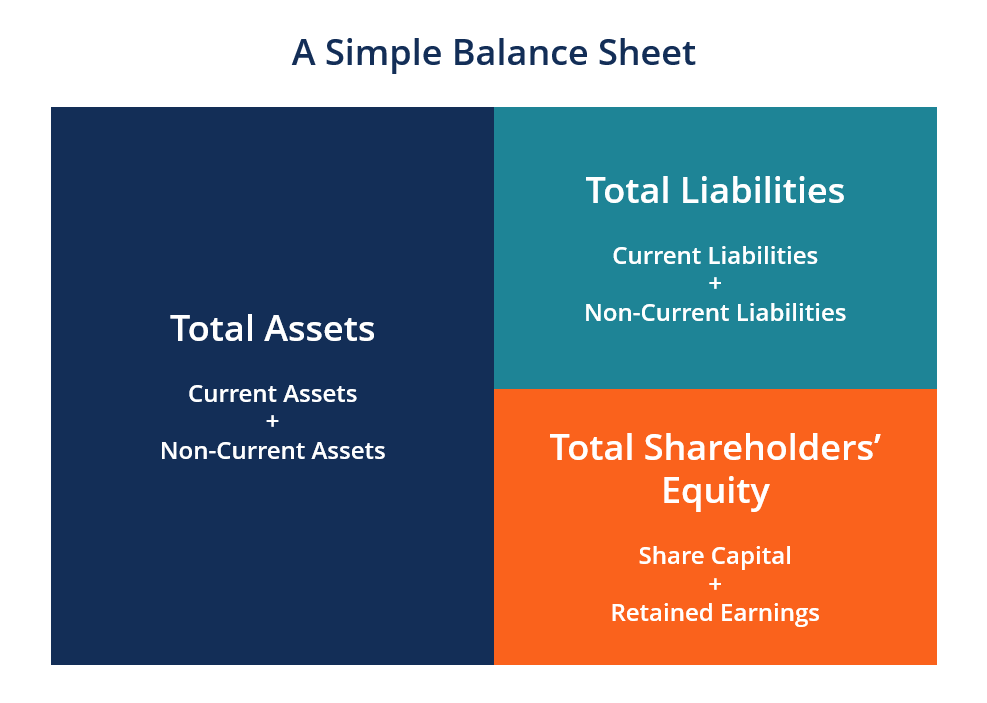

12. Balancing the equation:

The balance sheet adheres to the fundamental accounting equation: Assets = Liabilities + Equity. This means that the total value of assets should be equal to the combined value of liabilities and equity.

Remember, the way assets and liabilities categorized might slightly vary from firm to firm, but the basic principles remain the same. It’s important for architectural firms to maintain accurate and up-to-date balance sheets to assess their financial position and make informed business decisions.

To visit: https://www.mca.gov.in/

For further details access our website: https://vibrantfinserv.com