Asset and Liability Evaluation

1. Segregation of Income Streams:

Online content creators often have diverse income sources, including ad revenue, sponsorships, merchandise sales, and affiliate marketing. It’s essential to categorize and segregate these income streams appropriately in the balance sheet to provide a clear picture of their earnings.

2. Expense Classification:

Properly classifying expenses is key. Content creation expenses like equipment, software, and marketing costs should be record separately.

Additionally, ensure personal and business expenses are clearly distinguished to prevent mixing personal finances with business accounts.

3. Asset Valuation:

If content creators own assets like cameras, computers, or other equipment used for content production, these should be accurately valued based on their current market value. Any depreciation of these assets over time should also be accounted for.

4. Liabilities and Debts:

If the content creator has taken loans or incurred debts for their online activities, these should be clearly list in the balance sheet. It’s important to differentiate between short-term and long-term liabilities.

5. Recognition of Unearned Income:

If the creator offers subscription-based content or pre-sells products, any unearned income from these sources should be recorded as a liability until the obligations are fulfilled.

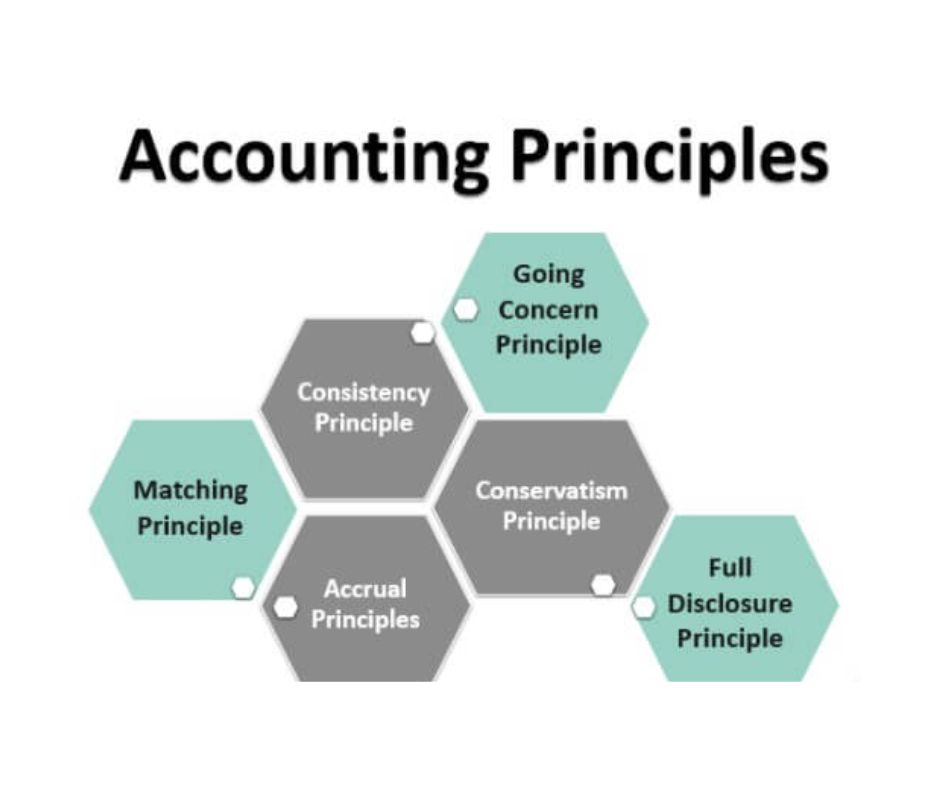

6. Accrual vs. Cash Basis:

Decide whether to present the balance sheet on an accrual basis (recognizing income when earned and expenses when incurred) or a cash basis (recording transactions when actual cash exchanged). The chosen method must accurately reflect the financial reality of the content creator’s operations.

7. Currency Conversion:

If the content creator earns income in different currencies, consider how to account for currency conversion rates accurately. This is important for presenting a true and fair representation of their financial position.

8. Intellectual Property Assets:

If the content creator holds intellectual property rights, such as copyrights or trademarks, these should be recognize as intangible assets on the balance sheet.

9. Contingent Liabilities:

Any potential legal or financial obligations that may arise from ongoing or pending issues should be disclose as contingent liabilities.

10 Consistency:

Maintain consistency in accounting methods and practices from one reporting period to another. It ensures that financial statements are comparable over time.

Considering these key points before drafting a balance sheet for online content creators will contribute to a comprehensive and accurate representation of their financial position and help them make informed decisions about their content creation endeavors.

FAQs:

To visit: https://www.mca.gov.in/

For further details access our website: https://vibrantfinserv.com