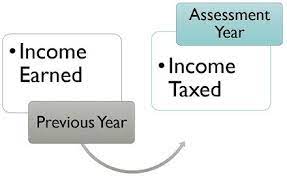

Assessment Year and Previous Year are two significant terms used in the Indian Income Tax Act of 1961, and their meanings are as follows:

Previous Year is a term use in the Indian Income Tax Act, 1961, which refers to the specific financial year during which the income is earn. For instance, if the income is generate within the financial year 2022-23, the previous year corresponding to that income would be 2021-22. For instance, if income is earn during the financial year 2022-23, the previous year corresponding to that income would be 2021-22.

Assessment Year is a term use in the Indian Income Tax Act, 1961, which denotes the year immediately succeeding the previous year. In simpler terms, it is the year in which the income earned during the previous year is evaluate, assess, and subject to taxation as per the provisions of the Income Tax Act. For instance, if the previous year is identify as 2021-22, then the corresponding assessment year would be 2022-23.

In simpler terms, the previous year is when the income is earn, and the assessment year is when the income is subject to taxation and evaluation.

FAQs:

For further details access our website:https://vibrantfinserv.com/

To visit:https://www.incometax.gov.in/

Contact: 8130555124, 8130045124

Whatsapp: https://wa.me/918130555124

Mail ID: operations@vibrantfinserv.com

Web Link: https://vibrantfinserv.com

FB Link: https://fb.me/vibrantfinserv

Insta Link: https://www.instagram.com/vibrantfinserv2/

Twitter: https://twitter.com/VibrantFinserv

LinkedIn: https://www.linkedin.com/in/vibrant-finserv-62566a259/