Tax planning vs financial planning

Tax planning vs financial planning

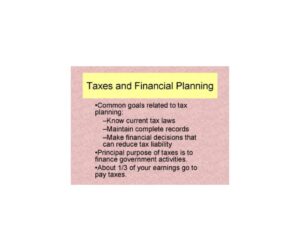

Tax planning vs financial planning, Tax planning and financial planning are related but distinct concepts that serve different purposes.

Here’s a comparison between tax planning and financial planning:

Tax Planning:

Focuses specifically on optimizing your tax situation and minimizing your tax liability.

Involves utilizing tax laws, deductions, exemptions, credits, and strategies to legally reduce your tax burden.

Aims to maximize tax efficiency by taking advantage of available tax breaks, deductions, and credits.

Typically involves analyzing your income, investments, deductions, and other financial factors to minimize taxes.

Primarily focuses on short-term tax savings and maximizing tax advantages within the existing tax framework.

Financial Planning:

Takes a broader and comprehensive approach to managing your finances and achieving your financial goals.

Involves assessing your entire financial picture, including income, expenses, investments, retirement planning, insurance, estate planning, and more.

Focuses on creating a holistic plan that aligns with your long-term financial goals, such as retirement, education funding, debt management, and wealth accumulation.Considers various factors, including cash flow management, risk tolerance, investment strategies, and asset allocation, to optimize your overall financial well-being.

Aims to provide a roadmap for achieving financial stability, growth, and security over the long term.

While tax planning is an integral part of financial planning, it represents just one aspect of the broader financial landscape. Financial planning takes into account various other factors beyond taxes to ensure your overall financial health and well-being. It considers your entire financial situation, goals, and objectives to develop a comprehensive plan that covers not only tax optimization but also savings, investments, insurance, retirement planning, and estate planning.

To visit- https://www.incometax.gov.in