![]()

Tax planning and Tax avoidance

Tax planning and Tax avoidance

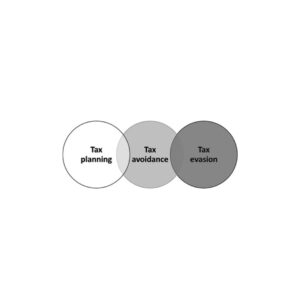

Distinguishing Between Tax Planning and Tax Avoidance:

Tax Planning:

Tax planning involves strategic financial decision-making within the framework of tax laws and regulations to minimize tax liabilities. So that, It focuses on utilizing available tax incentives, deductions, credits, and exemptions to optimize tax outcomes.

Key characteristics of tax planning include:

Legitimate Compliance: Tax planning operates within the boundaries of tax laws and regulations, ensuring full compliance and avoiding any illegal activities.

Maximizing Tax Benefits: Tax planning aims to identify and utilize legal strategies to reduce tax liabilities while maintaining compliance with tax laws.

Long-Term Perspective: Tax planning takes into account long-term financial goals and objectives, aligning tax strategies with broader financial planning objectives.

Transparency: Tax planning activities are generally transparent and fully disclosed to tax authorities.

For more information to visit- https://www.incometax.gov.in

Tax Avoidance:

Tax avoidance involves the legal use of loopholes, exemptions, and allowances in tax laws to minimize tax liabilities. It focuses on structuring financial affairs in a way that takes advantage of specific provisions in the tax code.

Key characteristics of tax avoidance include:

Exploiting Loopholes: Tax avoidance strategies aim to leverage legal loopholes, exemptions, or allowances within the tax system to reduce tax obligations.

Aggressive Tactics: Some tax avoidance practices may involve more aggressive approaches that push the boundaries of tax laws to gain tax advantages.

Risk of Scrutiny: While tax avoidance is legal, aggressive or questionable tax avoidance practices may attract scrutiny from tax authorities.

Potential Uncertainty: The effectiveness and acceptability of tax avoidance strategies may depend on changing tax laws and evolving interpretations by tax authorities.

However, It’s important to note that tax avoidance practices that involve intentionally misrepresenting or manipulating financial information to evade taxes are illegal and can lead to severe penalties. Consulting with a tax professional or advisor can help ensure that tax planning strategies remain within legal boundaries and align with your financial goals.

For further details access our website https://vibrantfinserv.com