Taxation for Expatriates

Taxation for Expatriates

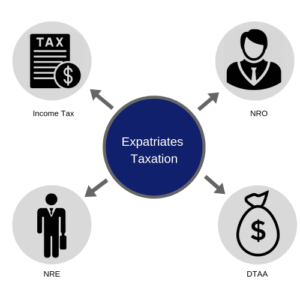

Taxation for expatriates, Expats frequently have the responsibility to fulfill tax obligations due to a multitude of reasons. The following key factors contribute to the tax responsibilities encountered by expats:

Citizenship or Residency-Based Taxation:

Many countries, such as the United States, tax their citizens or residents on their worldwide income, regardless of where they live. This means that even when residing abroad, expats may still be subject to tax obligations in their home country based on their citizenship or residency status.

Benefits and Services:

Taxes collected from individuals, including expats, help fund government programs, public services, and infrastructure in the home country. These services can include healthcare, education, transportation, social welfare programs, and more. Taxation for expatriates taxes ensures that individuals contribute their fair share toward the functioning and development of their home country.

Maintenance of Citizenship Rights:

Some countries require their citizens to fulfill their tax obligations to maintain certain rights and privileges associated with citizenship. Failure to meet tax obligations can result in penalties or the loss of certain benefits, such as the right to vote or access to consular services Taxation for expatriates.

Tax Treaties and Agreements:

Tax treaties between countries aim to prevent or mitigate double taxation for individuals who earn income in both their home and host countries. By adhering to these treaties, expats can benefit from exemptions, credits, or other measures that help avoid paying taxes twice on the same income.

Legal Compliance:

Paying taxes is a legal requirement in most jurisdictions. Failing to meet tax obligations can lead to penalties, fines, or legal consequences. Complying with tax laws ensures individuals remain in good standing with the tax authorities and avoids potential legal issues.

It’s important for expats to understand their tax obligations in both their home and host countries and to comply with the relevant tax laws. Seeking guidance from a tax advisor or an international tax specialist is recommended to ensure accurate tax filing and compliance with tax regulations in the appropriate jurisdictions.

To visit https://www.incometax.gov.in