![]()

How is HUF property divided

The division of property in a Hindu Undivided Family (HUF) typically occurs under certain circumstances when the HUF partition. Partition refers to the division of HUF assets among its members, resulting in each member obtaining their share of the property as separate individuals.

Here are some key points regarding the division of HUF property:

Partition:

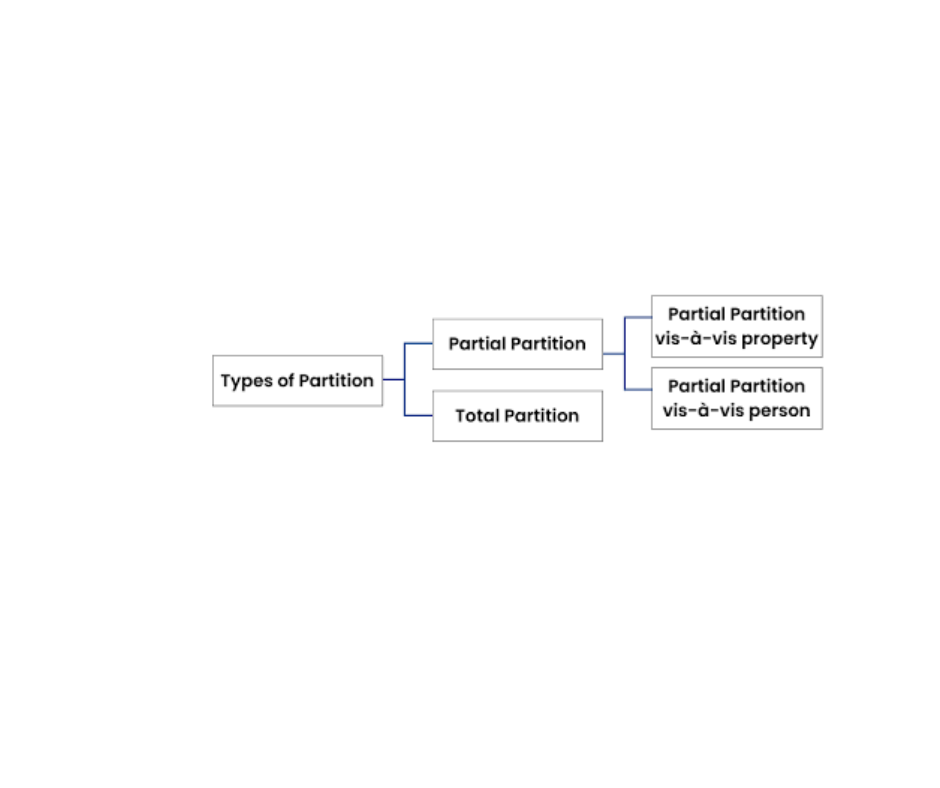

Partition can take place by mutual consent among the family members or by a legal process initiated by any member of the HUF. This can be partial, where only a portion of the HUF property is divided, or total, where the entire HUF property is divided.

For more information visit:https://www.incometax.gov.in

Share of Members:

Upon partition, each member of the HUF entitle to a share in the property. The shares are determined based on the respective rights of the members and can be decided by mutual agreement or through legal proceedings.

Separate Property:

After partition, the property received by each member becomes their separate property and they have the exclusive right to manage, use, and dispose of it as per their discretion.

Valuation:

The valuation of the HUF assets during partition usually based on fair market value. A proper assessment of the assets is essential to ensure a fair distribution among the members.

Documentation:

Therefore, It is advisable to document the partition process to avoid future disputes. A partition deed can prepare, specifying the details of the assets, their valuation, and the respective shares of the members. Although, This deed typically sign by all the affected family members.

Tax Implications:

The division of HUF property can have tax implications, including capital gains tax. It is important to consult with a tax professional or chartered accountant to understand the tax implications and comply with the relevant tax laws during the partition process.

For further details access our website https://vibrantfinserv.com