![]()

New vs Old Tax Regime

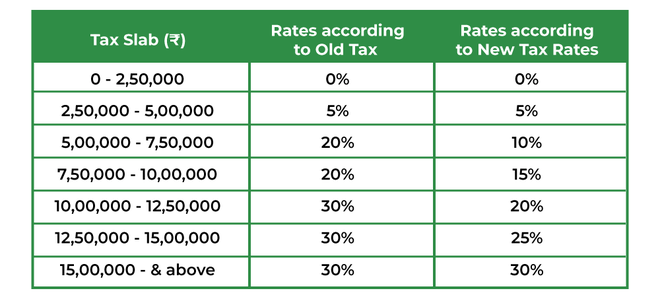

The new tax regime under the Income Tax Act in India, introduced in the Union Budget 2020-21, offers taxpayers an alternative tax structure with lower tax rates but without various deductions and exemptions available under the old tax regime.

New tax regime:

1. Lower Tax Rates:

The new tax regime presents lower tax rates in contrast to the old regime. It has seven slabs with reduced rates, ranging from 5% to 30% for different income levels.

2. No Deductions and Exemptions:

Taxpayers opting for the new regime forfeit various deductions and exemptions available under the old regime. This includes deductions under Section 80C (such as investments in PPF, EPF, life insurance premiums), Section 80D (health insurance premiums), Section 24 (home loan interest), etc.

3. Optional Choice:

Taxpayers have the option to choose between the old tax regime with deductions and exemptions or the new tax regime with lower rates but without deductions. They can select the regime that is more beneficial based on their individual financial circumstances.

4. Simplified Structure:

The new tax regime aims to simplify the tax structure by reducing the number of deductions and exemptions, making it easier for taxpayers to understand and comply with the tax laws.

5. Impact on Tax Liability:

The impact of choosing between the old and new tax regimes depends on various factors such as income level, eligible deductions, exemptions, and individual financial goals. Taxpayers need to evaluate both regimes to determine which one offers them greater tax savings.

6. Applicability to Certain Categories:

The new tax regime is applicable to individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession. Taxpayers with income from business or profession have the option to continue with the old tax regime.

7. Flexibility:

Taxpayers can switch between the old and new tax regimes from year to year based on their changing financial circumstances and tax planning needs. However, once the option for the new tax regime is chosen for a particular financial year, it cannot be changed during that year.

8. Tax Planning Considerations:

Taxpayers need to carefully evaluate their income sources, deductions, exemptions, and long-term financial goals before deciding between the old and new tax regimes. They may seek advice from tax professionals or financial advisors to make an informed decision.

Overall, the new tax regime offers taxpayers an alternative tax structure with lower rates but without various deductions and exemptions. Taxpayers need to assess their individual tax situations to determine which regime aligns better with their financial goals and objectives.

Old Tax Regime vs New Tax Regime

Old Tax Regime:

Allows taxpayers to claim various deductions and exemptions under different sections of the Income Tax Act, such as deductions for investments, housing loan interest, medical insurance premiums, etc.

Offers tax-saving options through deductions under Chapter VI-A of the Income Tax Act, resulting in lower taxable income and potentially lower tax liabilities.

Familiar and widely used by taxpayers accustomed to claiming deductions to reduce their tax burden.

New Tax Regime:

Introduces lower tax rates but eliminates most deductions and exemptions available under the old regime.

Offers a simpler tax structure with reduced tax rates across different income slabs, aiming to provide relief to taxpayers without the need for extensive tax planning or documentation.

Particularly beneficial for taxpayers who do not have significant deductions or who prefer simplicity over maximizing tax-saving opportunities.

Visit for more information: https://www.incometax.gov.in/iec/foportal/

File your ITR here

FAQs on New vs Old Tax Regime:

1. Which one is better new or old tax regime?

Ans: The decision to opt for either the new or old tax regimes depends on each individual financial situation:

i. Old Tax Regime: Better for those with significant deductions and exemptions, such as home loan interest, investments, and medical expenses. It can result in lower tax liabilities due to the availability of deductions.

ii. New Tax Regime: Better for those with fewer deductions or who prefer simplicity. It offers lower tax rates but eliminates most deductions, providing ease of compliance but potentially higher tax liabilities.

Ultimately, the better regime varies based on each taxpayer’s specific situation and preferences.

2. New vs old tax regime calculator.

Ans: A tax regime calculator helps taxpayers compare their tax liabilities under the old and new tax regimes based on their income and deductions. Link here.

3. New vs old tax regime FY 2023-24

Ans: In the financial year 2023-24, the old tax regime retains various deductions and exemptions, allowing taxpayers to lower their taxable income, while the new tax regime offers lower tax rates but eliminates most deductions, providing simplicity but potentially higher tax liabilities for some taxpayers.

4. New vs old tax regime for senior citizens?

Ans: For senior citizens:

i. Old Tax Regime:

- Offers various deductions and exemptions, including higher basic exemption limits and deductions for medical expenses and interest income.

- May result in lower tax liabilities for senior citizens with significant deductions.

ii. New Tax Regime:

- It provides lower tax rates but eradicates most deductions and exemptions.)

- Offers simplicity but may lead to higher tax liabilities for senior citizens reliant on deductions.

- Senior citizens should assess their individual financial situations to determine which regime is more beneficial based on their deductions and tax planning needs.

5. New vs old tax regime example.

Ans: Suppose we have two individuals, A and B, with the following details of their annual income and deductions:

- Annual Income: ₹10,00,000 (₹10 lakhs)

- Deductions under various sections (e.g., Section 80C, 80D, etc.): ₹2,00,000

- Now, let’s compare how their tax liabilities would differ under the old and new tax regimes:

Old Tax Regime:

- Income: ₹10,00,000

- Deductions: ₹2,00,000

- Taxable Income: ₹8,00,000

- Tax Calculation:

- Up to ₹2,50,000: 0%

- ₹2,50,001 to ₹5,00,000: 5% on ₹2,50,000 = ₹12,500

- ₹5,00,001 to ₹8,00,000: 20% on ₹3,00,000 = ₹60,000

- Total Tax Liability: ₹12,500 + ₹60,000 = ₹72,500

New Tax Regime:

- Income: ₹10,00,000

- No deductions allowed under new regime

- Tax Calculation (as per slab rates):

- Up to ₹2,50,000: 0%

- ₹2,50,001 to ₹5,00,000: 5% on ₹2,50,000 = ₹12,500

- ₹5,00,001 to ₹7,50,000: 10% on ₹2,50,000 = ₹25,000

- Total Tax Liability: ₹12,500 + ₹25,000 = ₹37,500

In this example:

Under the old tax regime, the total tax liability for individual A is ₹72,500, considering the deductions available.

Under the new tax regime, with no deductions allowed, the total tax liability for individual A is ₹37,500.

6. New tax regime vs old tax regime for salaried employees

Ans: The old tax regime offers more deductions but higher tax rates, while the new tax regime provides lower tax rates but fewer deductions. Salaried employees may prefer the old regime for tax-saving options, whereas the new regime offers simplicity with lower rates.

For further details access our website: https://vibrantfinserv.com/service-detail-13.php

Visit Income Tax Portal