![]()

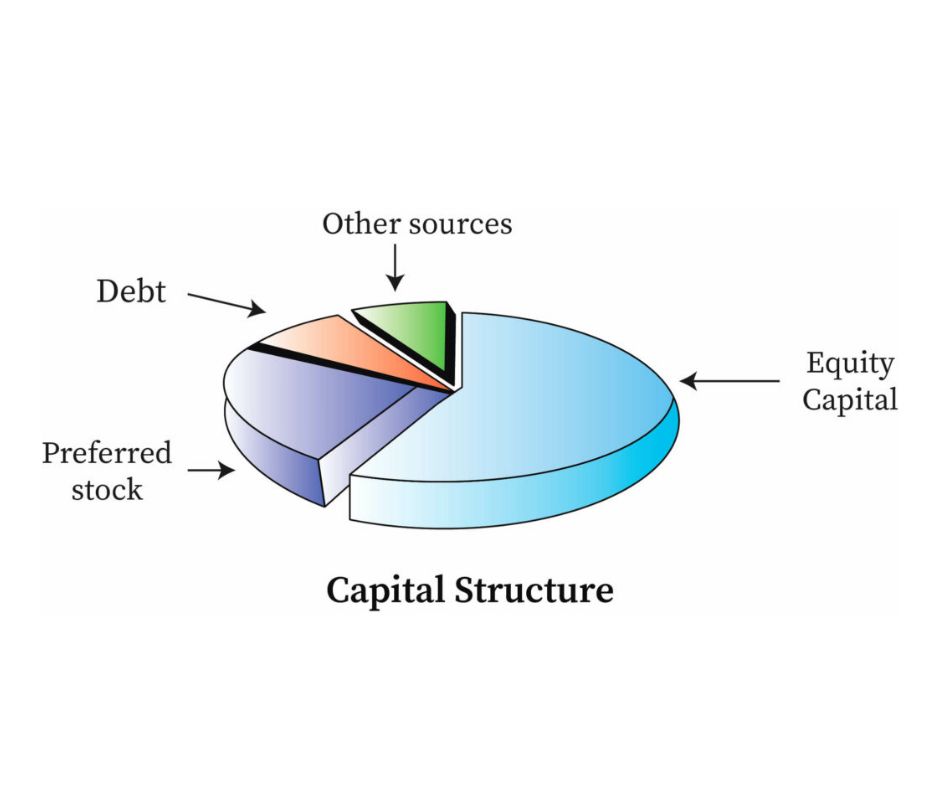

Capital structure

Capital structure refers to the composition of a company’s sources of funds, including debt, equity, and other forms of financing. It represents the way a company finances its operations, growth, and investments.

The way a company finances its operations, known as its capital, is crucial as it affects the company’s financial performance, level of risk, and cost of capital.

By determining the appropriate mix of debt and equity financing, a company can optimize its structure to achieve its financial goals while minimizing risk.

The optimal structure for a company varies depending on factors such as the industry, the company’s growth prospects, the level of competition, and the company’s financial goals. By maintaining an appropriate structure, a company can improve its creditworthiness, reduce its cost of capital, and maximize shareholder value.

For more information visit this site: https://www.incometax.gov.in

For further details visit https://vibrantfinserv.com/service-detail-25.php