![]()

15CA/CB Compliance

15CA/CB compliance involves adhering to the legal obligations established by the Indian government regarding the transfer of funds from residents to non-residents. It involves the submission of Form 15CA and obtaining Form 15CB to ensure proper reporting and taxation of cross-border transactions.

To achieve 15CA/CB compliance, the following steps need to be followed:

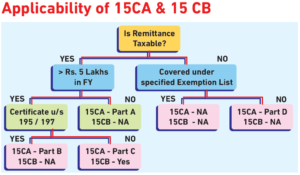

1.Determine applicability:

Assess whether the remittance falls under the scope of transactions that require compliance with 15CA/CB. Certain types of payments, such as those subject to tax deduction at source (TDS) or specified under the Income Tax Act, may require compliance.

2.Obtain Form 15CB:

Engage a chartered accountant (CA) to obtain Form 15CB. The CA will examine the transaction, verify tax-related details, and issue the certification in compliance with Indian tax laws. This certification ensures that the remittance is legitimate and meets the necessary requirements.

3.Complete Form 15CA:

The resident individual making the remittance must fill out Form 15CA, which captures important details about the transaction, including the purpose of the payment, taxability, and applicable tax rates. The form is submit electronically through the Income Tax Department’s online portal.

4.Submit Forms 15CA/CB definition:

Once the forms are filled and verified, they should be submitted to the appropriate authorities. Form 15CA is require to be submit electronically, while Form 15CB may need to be physically submit, depending on the instructions provided.

5.Retain documents:

It is crucial to retain copies of the submitted forms, along with the certification from the CA, as these serve as proof of compliance. They may be require for future reference or audit purposes.

By adhering to the 15CA/CB compliance process, individuals ensure that the necessary tax obligations are fulfil and that cross-border remittances are report accurately to the Indian government. This helps maintain transparency and accountability in financial transactions involving non-residents.

To visit: https://www.incometax.gov.in

For further details access our website: https://vibrantfinserv.com